Australia's Identified Mineral Resources 2023 Mineral Exploration

Page last updated:1 March 2024

Mineral Exploration

Ongoing high commodity prices for many minerals in 2022 (e.g. cobalt, lithium, nickel and zinc) continued to stimulate mineral exploration across Australia. This was buoyed by Western Australia opening its state border in March 2022 and the continued easing of other COVID-19 travel restrictions and isolation requirements across the country. Quarterly reports on mineral exploration data published by the Australian Bureau of Statistics14 show higher exploration expenditure throughout most of Australia. Total mineral exploration expenditure for the 2022 calendar year was up 13% to $4,055 million compared to $3,596 million in 2021 (Figure 3).

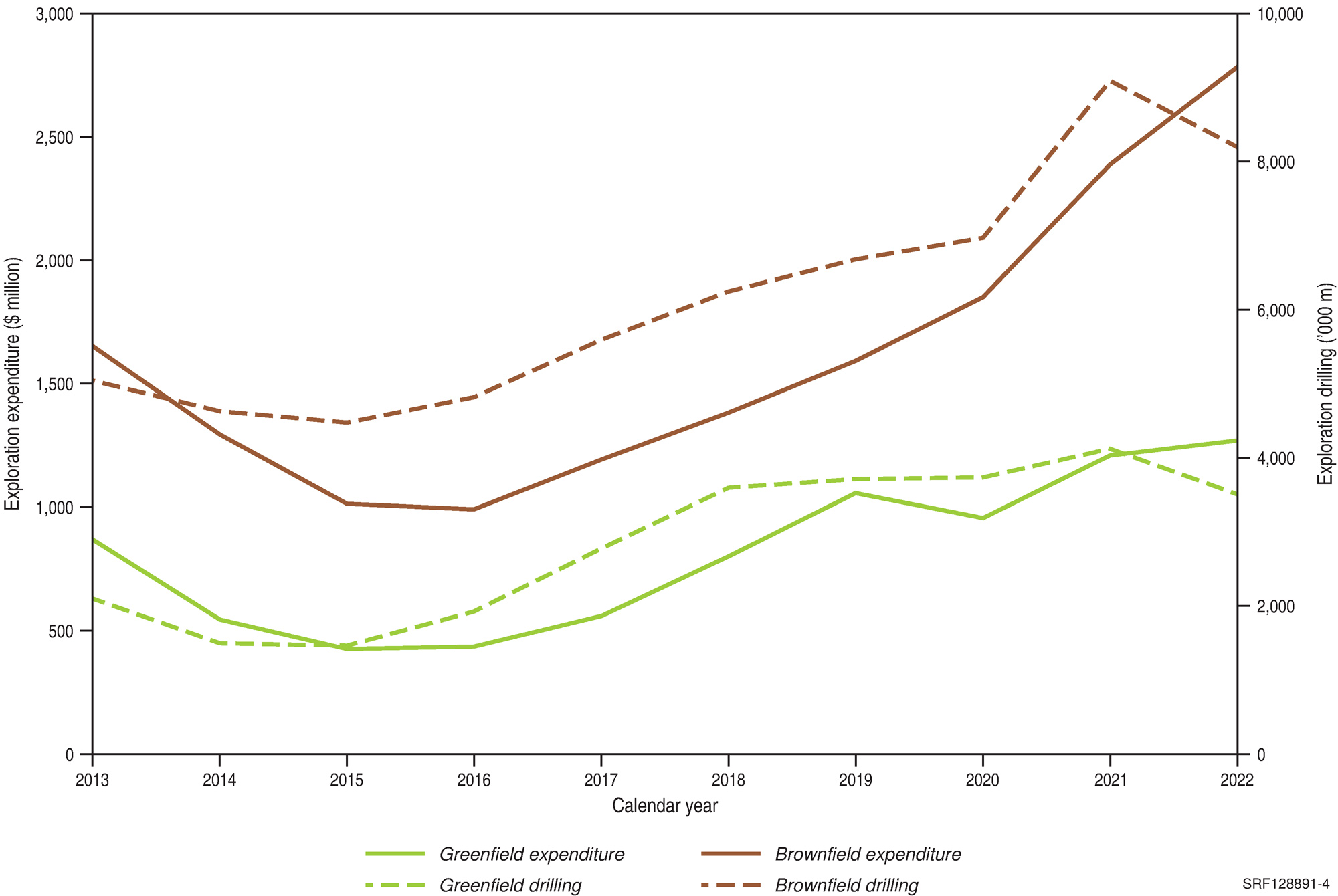

In the search for new mineral deposits, exploration expenditure and drilling in greenfield tenements was up 5.1% from $1,208 million in 2021 to $1,270 million in 2022, despite a 15% fall in metres drilled from 4,120,500 m in 2021 to 3,504,000 m in 2022 (Figure 4). Likewise, exploration expenditure and drilling around existing deposits (brownfield) was up 17% to $2,785 million in 2022 compared to $2,388 million in 2021, and metres drilled fell 10% to 8,195,700 m from 9,090,100 m in 2021 (Figure 4).

In 2022, exploration expenditure was at the highest levels ever recorded in New South Wales (up 17% to $351 million) and Western Australia (up 8.2% to $2,545 million; Figure 5). Western Australia accounted for 63% of national exploration expenditure in 2022, followed by Queensland with 14% ($553 million). In fact, most Australian jurisdictions saw an increase in exploration during 2022 as COVID-19 restrictions continued to ease. Tasmania (up 94% to $40.6 million) and South Australia (up 55% to $165 million) saw especially noteworthy increases.

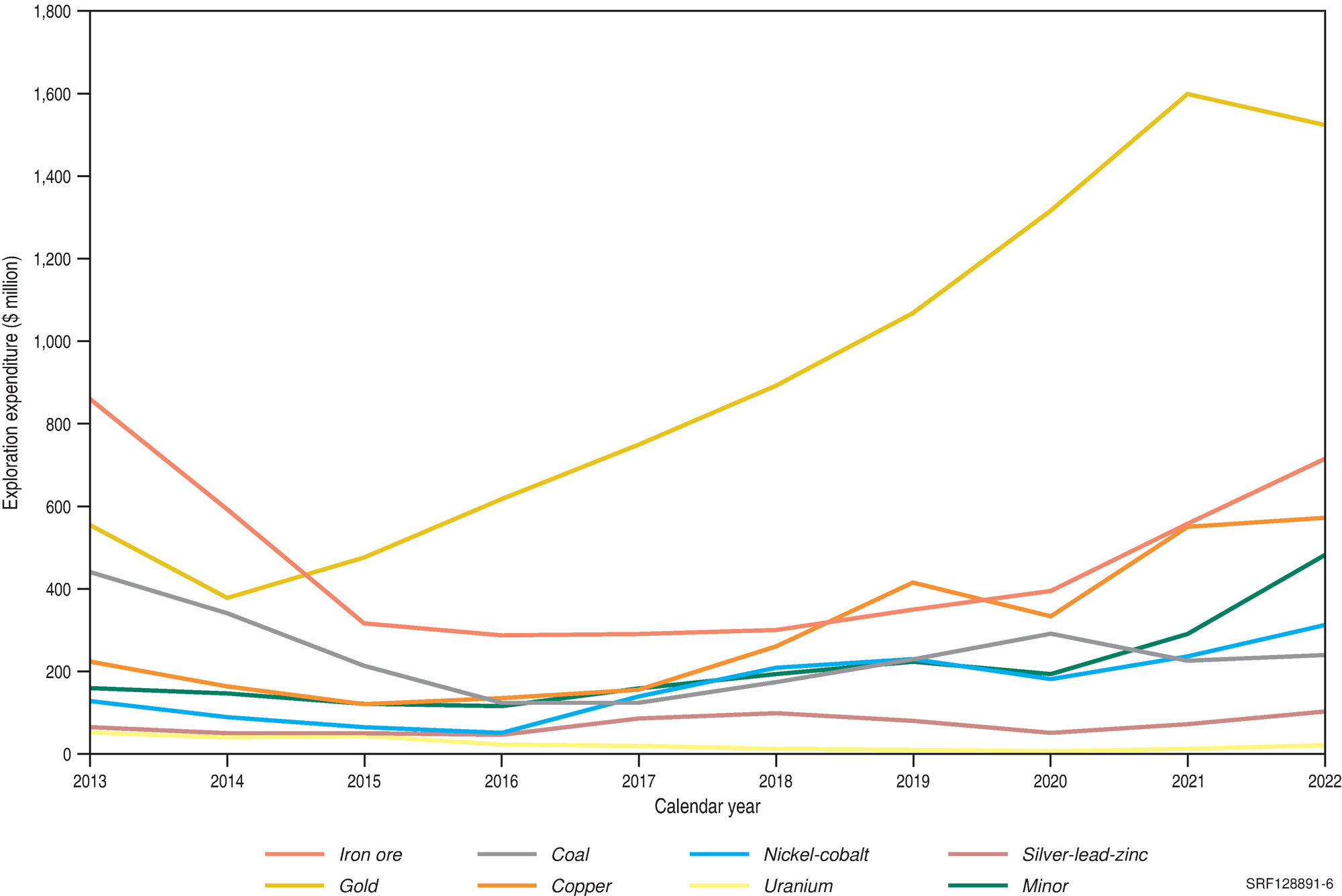

Gold remained the most explored for commodity in 2022, accounting for 38% of all mineral exploration expenditure (Figure 6). Iron ore attracted the next largest exploration expenditure in 2022, up 28% to $715 million from $557 million in 2021, followed by copper, up 4% to $573 million from $550 million in 2021 (Figure 6). In fourth place, minor metals (a category which includes many critical minerals such as rare earths and lithium) increased by 66%, from $291 million to $483 million, buoyed by the ongoing interest in critical minerals and the price of lithium spodumene concentrate which jumped to US$4,364/t, from US$947/t in 2021.

The growing momentum for new sources of raw materials saw mineral sands exploration expenditure increase by 46%to $67 million, up from $46 million in 2021, and lead-zinc-silver increase by 42% to $103 million, up from $73 million in 2021 (Figure 6). The only commodities that saw a decline in exploration expenditure in 2022 were diamonds, down 48% from $5.6 million in 2021 to $2.9 million, and gold, down 5% from $1,599 million in 2021 to $1,524 million.

Flooding on Australia's east coast created supply limitations for some commodities and contributed to inflationary pressures, as did Russia's invasion of Ukraine, which resulted in substantial energy price rises in many parts of the world. Thermal coal prices increased from US$135/t in 2021 to US$359/t in 2022, metallurgical coal prices increased from US$222/t in 2021 to US$364/t in 2022, and overall coal exploration spending was up by 6%. The high price of energy, along with increasing climate change concerns, stimulated increased interest in nuclear energy as a source of reliable carbon-free electricity. This interest saw exploration spending for uranium in Australia increase by 76%, up from $12.3 million in 2021 to $21.7 million in 2022.

14 ABS, Quarterly Statistics, Mineral and Petroleum Exploration Australia September 2022 (accessed 5 December 2022).