Scandium

Page last updated:19 December 2023

Please note that this page is currently under review.

Resource figures are current as at 31 December 2018.

Scandium (Sc) is commonly grouped with yttrium (Y) and the 15 elements of the lanthanide series, historically regarded as the rare earth elements (REE). While scandium is not uncommon, with an abundance of around 25 ppm in the Earth’s crust, scandium, like REE, generally does not occur in concentrations that can support commercial mining operations. It is usually produced as a by-product to other metals and processing is difficult. Thus, there are few reliable sources of scandium in the world and limited adoption of scandium in commercial applications.

A major use of scandium is in the production of alloys for the aerospace industry. It is also used in solid oxide fuel cells, in specialised lighting applications, ceramics, lasers, electronics and in alloys with aluminium for sporting goods production.

The strategic importance of scandium was emphasised by its inclusion in the US government’s 2018 list of 35 critical minerals1. This list was an initial step toward ensuring reliable and secure supplies of minerals critical to the US economy and military.

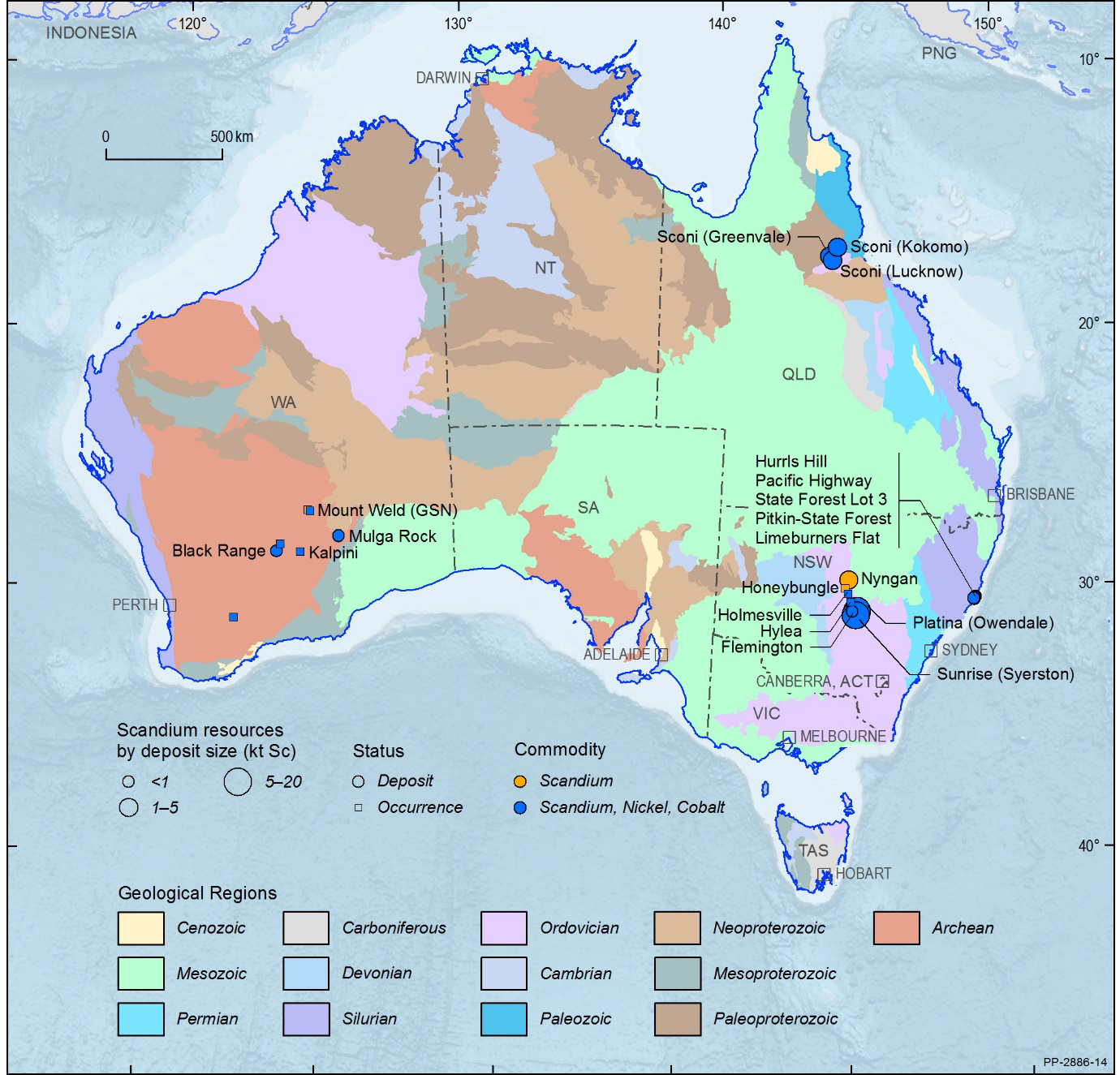

This review is Geoscience Australia’s first comprehensive overview of Australia’s scandium resources and related industry activity. Known Australian occurrences of scandium are mostly associated with lateritic nickel-cobalt mineralisation. Australian resources of scandium occur in Queensland, New South Wales and Western Australia but none are currently mined. However, scandium demand is expected to rise with increased usage of solid oxide fuel cells and aluminium-scandium alloys. Australian scandium projects offer potential new sources of stable supply that may, in turn, stimulate the use of scandium in a wider range of new technologies.

JORC Reserves

As at 31 December 2018, Proved and Probable Ore Reserves of scandium, reported in compliance with the JORC Code, were 12.14 kt (Table 1). Reserves accounted for 47% of Australia’s Economic Demonstrated Resources (EDR) and have been reported from four projects – Nyngan, Owendale and Sunrise (Syerston) in New South Wales and Sconi in Queensland.

Table 1. Australia's Ore Reserves of scandium and production 2018.

| Year | Ore Reserves1 (kt Sc) | Production (kt Sc) |

|---|---|---|

| 20182 | 12.14 | 0 |

kt Sc = thousand tonnes of scandium metal.

- The majority of Australian Ore Reserves and Mineral Resources are reported in compliance with the JORC Code, however, some companies report to foreign stock exchanges using other reporting codes, which are largely equivalent. In addition, Geoscience Australia may hold confidential information for some commodities.

- Geoscience Australia did not assess scandium Ore Reserves and Mineral Resources prior to 2018.

Identified Resources

Australia had EDR of 26.05 kt of scandium at 31 December 2018. Also at the end of 2018, Australia had 7.64 kt of Subeconomic Resources and 19.49 kt Inferred Resources of scandium (Table 2).

Accessible EDR

Some mineral resources are inaccessible for mining because of environmental restrictions, government policies or because they occur within military lands or national parks. All of Australia’s EDR of scandium are considered to be accessible.

Table 2. Australia's identified resources of scandium and world figures 2018.

| Year | Demonstrated Resources | Inferred Resources2 (kt Sc) | Accessible EDR3 (kt Sc) | Australian Mine Production (kt Sc) | World Economic Resources (kt Sc) | World Mine Production (kt Sc) | ||

|---|---|---|---|---|---|---|---|---|

| Economic (EDR)1 | Paramarginal | Submarginal | ||||||

| 2018 | 26.05 | 7.64 | 0 | 19.49 | 26.05 | 0 | n.a. | n.a. |

kt Sc = thousand tonnes of scandium metal; n.a. = not available.

- Economic Demonstrated Resources (EDR) predominantly comprise Ore Reserves and most Measured and Indicated Mineral Resources that have been reported in compliance with the Joint Ore Reserves Committee (JORC) Code to the Australian Securities Exchange (ASX). In addition, some reserves and resources may have been reported to foreign stock exchanges using other reporting codes, which are largely equivalent to the JORC Code. Geoscience Australia may also hold some confidential data.

- Total Inferred Resources in economic, subeconomic and undifferentiated categories.

- Accessible Economic Demonstrated Resources (AEDR) is the portion of total EDR that is accessible for mining. AEDR does not include resources that are inaccessible for mining because of environmental restrictions, government policies or military lands.

Exploration Expenditure

Exploration expenditure data for scandium are not reported by the Australian Bureau of Statistics.

Production

Scandium is not currently mined in Australia.

World Ranking

Scandium rarely occurs in elevated concentrations as it has little affinity with itself and tends to disperse in the earth’s crust. Despite this, The United States Geological Survey (USGS) describes scandium resources as abundant with deposits known in Australia, Canada, China, Kazakhstan, Madagascar, Norway, the Philippines, Russia, Ukraine and the USA2. The USGS does not, however, report global resource tonnages.

World data on scandium production is also not readily available and the global market is limited. The USGS writes that scandium was produced in recent years as a by-product from the processing of a variety of ores in a number of countries: China (from iron ore, REE, titanium and zirconium processing), Kazakhstan (uranium), Russia (apatite and uranium) and Ukraine (uranium)3. Australian deposits have the potential to provide scandium as a primary or co-product resulting in new and larger scandium markets.

Industry Developments

Current interest in scandium is shown by the range of projects located in Queensland, New South Wales and Western Australia (Figure 1). This section highlights recent company exploration and development-related activities. Companies use a range of units to report tonnage and grade and these have generally not been converted from the original source material. All reported reserves and resources are compliant with the JORC Code unless otherwise stated.

Figure 1. Australian scandium deposits as at 31 December 2018.

kt Sc = thousand tonnes of scandium content. Resource size is based on total resources (Measured + Indicated + Inferred, inclusive of Ore Reserves).

Flemington Deposit: The Flemington cobalt-nickel-scandium project is located 370 km west of Sydney and was purchased by Australian Mines Ltd from Jervois Mining Ltd in 2018. In August 2012, Jervois reported that the last drill hole in a small program on EL7805 (Syerston) intersected mineralisation which returned significant levels of scandium and vanadium including: 2 m @ 230 ppm Co, 327 ppm Sc (502 ppm Sc2O3), 1165 ppm V; 2 m @ 175 ppm Co, 455 ppm Sc (698 ppm Sc2O3), 496 ppm V and 1 m @ 973 ppm Co, 343 ppm Sc (526 ppm Sc2O3), 929 ppm V.

The company stated that this initial drilling had targeted the northern section of the Tout Intrusive Complex which the Geological Survey of New South Wales considered to be an Alaskan-Type ultramafic intrusive4. Ongoing drilling and exploration resulted in an initial scandium resource estimate in August 2015 comprising of: Measured Resources of 2.675 Mt @ 435 ppm Sc, Indicated Resources of 0.468 Mt @ 426 ppm Sc for a total resource of 3.143 Mt @ 434 ppm Sc and contained metal of 1363 t Sc. Around 75% of the resource is in a limonitic laterite5.

Subsequently, Australian Mines confirmed that the mineralisation occurs in laterites developed on rocks of the Tout Intrusive Complex, probably of late Ordovician to early Devonian age. Australian Mines released a revised resource estimate in October 2017 in which they emphasised the cobalt potential of the deposit.

Resources were reported for a Cobalt-Scandium Zone (300 ppm Co cut-off grade) and a Scandium Zone (300 ppm Sc cut-off grade). The Cobalt-Scandium Zone estimate was a Measured Resource of 2.5 Mt @ 1037 ppm Co, 403 ppm Sc and 2477 ppm Ni for 2577 t of contained cobalt, 1001 t of contained scandium and 6152 t of contained nickel and an Indicated Resource of 0.2 Mt @ 765 ppm Co, 408 ppm Sc and 1809 ppm Ni for 167 t of contained cobalt, 89 t of contained scandium and 395 t of contained nickel6. Measured Resources in the Scandium Zone were 1.6 Mt @ 103 ppm Co, 430 ppm Sc and 710 ppm Ni for contained metal of 164 t cobalt, 688 t scandium and 1138 t nickel. Indicated Resources in the Scandium Zone were 0.2 Mt @ 94 ppm Co, 455 ppm Sc and 484 ppm Ni for a metal content of 21 t cobalt, 99 t scandium and 106 t nickel.

At the end of 2018, Australian Mines expressed belief in the potential to expand the current resources at Flemington and prepared a drilling program7. Subsequently the company reported that the first results from that drilling suggested that the mineralised horizon extends beyond the boundaries of the already defined Flemington resource8. Intersections reported included zones enriched in cobalt and scandium and anomalous zones of copper. These included:

- Hole FMA19_371 — 12 m @ 1732 ppm Co from 10 m depth, 12 m @ 402 ppm Sc and 2240 ppm Cu from 9 m depth;

- Hole FMA19_377 — 10 m @ 1600 ppm Co from 4 m depth, 10 m @ 267 ppm Sc from 1 m depth and 6 m @ 3376 ppm Cu from 4 m depth; and

- Hole FMA19_371 — 5 m @ 1383 ppm Co from 13 m depth and 20 m @ 425 ppm Sc from 8 m depth.

Holmesville Prospect: This deposit is situated some 40 km south of Nyngan and is in Alpha HPA Ltd’s (previously Collerina Cobalt Ltd) Collerina Project that was reported as a high-grade cobalt discovery. Drill intersections returned scandium assays including 11 m @ 0.27% Co, 0.54% Ni, 8.0% Al and 248 ppm Sc and 32 m @ 0.26% Co, 0.52% Ni, 5.9% Al and 96 ppm Sc9.

Subsequently, the company has focussed on the potential to develop a facility to produce high-purity alumina (HPA) using their proprietary solvent extraction and refining technology to process a blended industrial aluminium chemical feedstock. However, the company said it still considered that the Collerina Project had the potential to produce nickel, cobalt and scandium but further studies were required to assess the technical and financial case for integrating Collerina into the HPA project10.

Honeybungle Prospect: Scandium International Mining Corp’s (previously EMC Metals Corp) Honeybungle property is located in EL7977, 24 km west-southwest of its Nyngan project. The Honeybungle property has four magnetic anomalies – Seaford, Woodlong, Yarran Park and Mallee Valley. In 2014, the company completed an aircore drilling programme in the Seaford area and reported that the results suggest mineralisation was similar to that at Nyngan. Intersections reported included 3 m @ 572 ppm Sc, 3 m @ 510 ppm Sc and 3 m @ 415 ppm Sc. In addition, a 13-drill hole cluster, where intersections averaged 270 ppm Sc, was identified11.

Hurrls Hill Deposit: This deposit is located near Port Macquarie on the central coast of New South Wales. It was explored by Jervois Mining Ltd in the late 1990s as part of its Lake Innes project and, although a resource estimate was prepared, the company relinquished the leases to concentrate on other prospects. The resource estimate of March 2001 was reported to be in the “indicated” category and was 10.77 Mt @ 0.66% Ni, 0.1% Co and 40.1 ppm Sc12. The resource data for Hurrls Hill was published by Resources and Geoscience NSW in 2018 as an Inferred Resource of 10.8 Mt @ 0.66% Ni, 0.10% Co and 41 ppm Sc for 1080 t of contained cobalt and 443 t of scandium13.

Hylea Project: Hylea is a cobalt-focussed project that has returned significant drill intersections of scandium and other metals. It is located 20 km to the southwest of Tottenham and is owned by Hylea Metals Ltd. The Tiger’s Creek prospect is the most advanced target in the project. Geologically it is on the eastern edge of the Hylea Ultramafic Intrusive Complex composed of dunite-pyroxenite-hornblendite-monzonite units that are overlain by a lateritic regolith profile. The laterite is from 10 to 70 m thick and has cobalt, nickel, platinum and scandium enrichment.

In June 2018, the company reported soil sampling and drilling on the Tiger’s Creek prospect and drill intersections included overlapping mineralised cobalt, scandium, platinum and nickel zones. Significant scandium intersections included:

- 7 m @ 540 ppm Sc, 0.025% Co, 0.08% Ni, 0.13 ppm Pt and 5.76% Al from 7 m down-hole; and

- 9 m @ 446 ppm Sc, 0.08% Co, 0.14% Ni, 0.43 ppm Pt and 6.63% Al from 15 m down-hole14.

Further encouraging scandium intersections were reported in August 2018 and included:

- 31 m @ 471 ppm Sc, 0.04% Co, 0.16% Ni, 0.10 ppm Pt and 7.39% Al from 26 m down-hole; and

- 12 m @ 528 ppm Sc, 0.06% Co, 0.11% Ni, 0.17 ppm Pt and 6.34% Al from 29 m down-hole15.

Lake Innes Project (Others): The Lake Innes Project consisted of a number of prospects explored by Jervois Mining Ltd in the 1990s in the Port Macquarie-Wauchope district. Two of these, Hurrls Hill and Pacific Highway, are reported elsewhere in this review. Lateritic nickel-cobalt-scandium “indicated” resources were reported for five deposits in the Lake Innes project with Hurrls Hill and Pacific Highway the largest. Resources in the other deposits were:

- State Forest Lot 3: 1.32 Mt @ 0.44% Ni, 0.08% Co and 47.5 ppm Sc;

- Pitkin-State Forest: 1.12 Mt @ 0.33% Ni, 0.04% Co and 53.9 ppm Sc; and

- Limeburners Flat: 1.01 Mt @ 0.51% Ni, 0.04% Co and 40.2 ppm Sc16.

Nyngan Deposit: In 2013, EMC Metals Corp (now Scandium International Mining Corp) acquired the Nyngan project, 20 km west of the town of Nyngan, from Jervois Mining Ltd. In 2008, a scandium-rich portion of the deposit had a Measured Resource of 2.718 Mt @ 274 ppm Sc and an Indicated Resource of 9.294 Mt @ 258 ppm Sc17. Scandium International released revised resource estimates in a feasibility study in April 2016 comprising Measured Resources of 5.69 Mt @ 256 ppm Sc and Indicated Resources of 11.23 Mt @ 225 ppm Sc18. Proved Reserves of 794 514 t @ 394 ppm Sc and Probable Reserves of 641 915 t @ 428 ppm Sc were reported as having been established over part of the resource19.

The scandium resource is in a highly weathered ultramafic zone that may extend to a depth of 60 m over the Gilgai Intrusive Complex, which underlies the project area and is thought to be the source of the scandium, nickel, cobalt and precious metals in the regolith. The feasibility study indicated that the project had the potential to produce an average of 37 690 kg of scandium oxide annually over a 20-year project life20.

In April 2019, the NSW Department of Planning and Environment advised Scandium International Mining that its mining lease ML1763 was now considered invalid because a previous objection lodged by a local landowner had not been ruled upon by the Department. The company said that three courses of action were underway to resolve the matter including proper determination by the Department21. In May 2019, the Scandium International Mining announced that it had lodged a new mining lease application with the New South Wales Government (MLA568) to progress the project while the status of the original mining lease is determined. The company noted that the area covered by the new application does not include the land that was the subject of the landowner objection to ML176322.

Owendale Project: Platina Resources Ltd’s project is based on the Red Heart deposit in the Owendale Intrusive Complex, 53 km northeast of Condobolin. Initial exploration in the area focussed on platinum but attention turned to scandium in 2017. Mineralisation at Red Heart is in laterite overlying an Alaskan style intrusive complex with both mafic-felsic and ultramafic units. The grade of nickel, cobalt, scandium and platinum in the ultramafics has been enriched in the laterites23.

A definitive feasibility study (DFS) indicated that an operation based on a low-strip, open-cut mine and a processing plant to produce scandium oxide was viable24. The study showed that a staged production regime increasing from 20 tonnes per annum (tpa) of 99.99% scandium oxide to 40 tpa, as demand rises, with an initial mine life of 30 years was viable.

An updated Mineral Resource estimate was released in August 201825. At a 300 ppm Sc cut-off grade the resources were:

- Measured — 7.8 Mt @ 435 ppm Sc, 0.42 g/t Pt, 0.13% Ni and 0.07% Co;

- Indicated — of 12.5 Mt @ 410 ppm Sc, 0.26 g/t Pt, 0.1% Ni and 0.06% Co; and

- Inferred — 15.3 Mt @ 380 ppm Sc, 0.22% Pt, 0.08% Ni, 0.05% Co.

The contained metal in the total resource was reported to be 22 000 t Sc2O3, 317 000 oz Pt, 35 700 t Ni and 20 500 t Co.

Subsequently, Platina announced a 5% increase in Ore Reserves for the project with combined Proved and Probable Reserves of 4.027 Mt @ 570 ppm Sc, 0.12% Ni and 0.09% Co for a contained 3512 t Sc2O3, 4821 t Ni and 3599 t Co. Ore Reserves have only been assessed for some of the areas targeted for initial mining26.

Pacific Highway Deposit: Exploration on the Pacific Highway deposit, located about 10 km southeast of Wauchope, was carried out by Jervois Mining Ltd in the 1990s as part of its Lake Innes project. An initial resource estimate was reported by the Company to be in the “indicated” category and was 1.52 Mt @ 0.83% Ni, 0.07% Co and 30.0 ppm Sc27. The nickel-cobalt-scandium enrichment occurs in a lateritic profile which overlies a serpentinite basement.

In 2018, MinRex Resources Ltd undertook a review of historical data for the prospect with the aim of defining a high-grade cobalt resource. The review was part of a due-diligence program to determine whether the company should complete acquisition of the project. An Inferred Resource of 697 000 t @ 1157 ppm Co, 9043 ppm Ni and 39.5 ppm Sc for 806 t of contained cobalt, 6301 t of nickel and 27.5 t of scandium was reported28. Subsequently, the company did not proceed with the acquisition.

Sunrise (Syerston) Project: The Sunrise project was formerly referred to as the Syerston project and is located near Fifield about 370 km west of Sydney. It is principally a nickel-cobalt project with significant scandium mineralisation. The current project owners, Clean Teq Holdings Ltd, released an updated Mineral Resource estimate for scandium in 2016 and, subsequently, a detailed resource update for the whole project in 2017 including revised resource data for scandium.

This review determined that scandium occurred in two distinct populations: a lower grade scandium resource, overlying the main basement of dunite, which is included in the main nickel-cobalt mineralisation and a higher grade scandium resource laterally surrounding the main nickel-cobalt mineralisation. The total scandium resource reported at a 300 ppm Sc cut-off grade comprises:

- Measured and Indicated Resources of 12.3 Mt @ 420 ppm Sc for a contained 5175 t Sc (7917 t Sc2O3); and an

- Inferred Resource of 33.3 Mt @ 421 ppm Sc for a contained 14 047 t Sc (21 492 t Sc2O3).

Almost all of the resource, 45.4 Mt of the total 45.7 Mt, lies outside the dunite basement zone29.

A DFS indicated that Sunrise could sustain a long-life, low cost operation for nickel and cobalt production and an average scandium oxide production capacity of 80 tpa, but with sales capped at 10 tpa for the purposes of the DFS. It suggested that initial scandium production would be 131.8 tpa of scandium hydroxide which would be batch treated on site to produce scandium oxide. Resource estimates on which the DFS was based were, at a 0% Co cut-off grade:

- Measured Resources of 68.8 Mt @ 0.63% Ni, 0.10% Co and 62 ppm Sc;

- Indicated Resources of 93.9 Mt @ 0.47% Ni, 0.08% Co and 86 ppm Sc; and

- Inferred Resources of 20.6 Mt @ 0.23% Ni, 0.09% Co and 293 ppm Sc.

Ore Reserves estimated for the project from these resources were Proved Reserves of 65.5 Mt @ 0.65% Ni, 0.10% Co and 48 ppm Sc and Probable Reserves of 81.9 Mt @ 0.49% Ni, 0.08% Co and 57 ppm Sc30.

Sconi Project:Australian Mines Ltd’s Sconi cobalt-nickel-scandium project is centred on the Greenvale area 250 km west-northwest of Townsville and includes the Kokomo, Lucknow and Greenvale lateritic deposits. A bankable feasibility study (BFS) supported the development of open-pit mines at each deposit and a 2 Mtpa processing plant for the project31. The BFS envisaged annual production of 8496 t of cobalt sulphate and 53 301 t of nickel sulphate. In addition, there would be 89 t of scandium oxide produced but the BFS anticipated that only around 10% of this would be sold. Australian Mines is looking to advance utilisation of the project’s scandium output.

The BFS reported that the Ore Reserves for the Sconi Project were: Proved Reserves of 6.93 Mt @ 0.79% Ni, 0.10% Co and 45 ppm Sc and Probable Reserves of 26.97 Mt @ 0.63% Ni, 0.10% Co and 42 ppm Sc. While the BFS reported the scandium grades for the Ore Reserves, it did not, however, report the scandium grades for the Mineral Resources.

Previously, Australian Mines completed the purchase of the Sconi project from Metallica Minerals Ltd in December 2017. Combined Measured, Indicated and Inferred Mineral Resource estimates published, before the sale of the project, by Metallica Minerals in its 2017 Annual Report were:

- Kokomo — 29.5 Mt @ 0.49% Ni, 0.08% Co and 55 g/t Sc;

- Lucknow — 13.8 Mt @ 0.31% Ni, 0.07% Co and 116 g/t Sc;

- Greenvale in situ — 16.3 Mt @ 0.73% Ni, 0.05% Co and 38 g/t Sc; and

- Greenvale dumps and stockpiles — 11.1 Mt @ 0.42% Ni, 0.03% Co and 44 g/t Sc.

In February 2019, Australian Mines released updated resource estimates for the Sconi deposits but did not include scandium grades32. The revised total Measured, Indicated and Inferred Resources are:

- Kokomo — 28.47 Mt @ 0.57% Ni and 0.09% Co;

- Lucknow — 14.62 Mt @ 0.48% Ni and 0.11% Co; and

- Greenvale (including stockpiles) — 32.63 Mt @ 0.69% Ni and 0.05% Co.

In mid-2019, an updated Ore Reserve estimate was released33. Total Proved and Probable Reserves were 57.30 Mt @ 0.58% Ni, 0.08% Co and 35 ppm Sc. The Ore Reserves were:

- Kokomo — 18.96 Mt @ 0.58% Ni, 0.10% Co and 33 ppm Sc;

- Lucknow — 20.77 Mt @ 0.42% Ni, 0.08% Co and 39 ppm Sc; and

- Greenvale — 17.57 Mt @ 0.76% Ni, 0.06% Co and 31 ppm Sc.

Black Range Deposit:Ardea Resources Ltd’s Black Range deposit is located about 50 km south of Menzies and southwest of its Goongarrie nickel-cobalt project. Black Range had an established nickel-cobalt resource which was re-evaluated in 2017 and the company announced that new scandium, platinum and palladium (PGE34) resources were added to the deposit inventory. The revised nickel-cobalt resource is overlapped by the new scandium and PGE resources. If the nickel-cobalt resource is to be mined, the scandium and PGE resources will also have to be mined to allow access to the nickel-cobalt mineralisation35.

The new and revised Indicated and Inferred Resources were:

- Nickel-cobalt — 19.22 Mt @ 0.68% Ni, 0.09% Co, 0.55% Mn, 33.4 g/t Sc, 0.09 g/t Pt and 0.13 g/t Pd;

- scandium resources (outside of the nickel-cobalt resource) — 4.70 Mt @ 0.24% Ni, 0.02% Co, 68.4 g/t Sc, 0.24 g/t Pt and 0.21 g/t Pd; and

- PGE resources (outside of the nickel-cobalt resource) — 3.00 Mt @ 0.15% Ni, 0.01% Co, 0.35 g/t Pt and 0.15 g/t Pd.

The company stated that the PGE and scandium resources occur as a blanket either above or coincident with the nickel-cobalt mineralisation.

Goongarie Project:At Goongarrie,southeast of Menzies, Ardea Resources Ltd announced in late 2017 that first-pass resampling of old drill samples had revealed extensive scandium enrichment in the Goongarrie South area. Initial assays had shown that there were two main areas of continuous scandium mineralisation with grades in excess of 50 g/t Sc. These are on the Pamela Jean-Patricia Anne line, where a strike length of over 2.4 km was identified, and on the Elsie Tynan line with a strike length of over 1.2 km. Intersections included 8 m @ 104.2 g/t Sc from 14 m depth, 18 m @ 62.5 g/t Sc from 18 m and 35 m @ 96.1 g/t Sc from 19 m depth36.

As part of its DFS program at Goongarie, Ardea undertook additional drilling and subsequently announced that intersections at the Patricia Anne deposit had yielded high nickel-cobalt grades with consistent scandium grades. The scandium enrichment is within, and overlies, the nickel-cobalt mineralisation. Intersections included 42 m @ 1.43% Ni, 0.16% Co, 46 g/t Sc and 38 m @ 1.08% Ni, 0.04% Co and 46 g/t Sc37.

Drilling at the Pamela Jean Deeps to the south of Patricia Anne also returned encouraging intersections including 112 m @ 1.30% Ni, 0.26% Co and 31 g/t Sc from 30 m depth and 76 m @ 1.11% Ni, 0.09% Co and 38 g/t Sc from a depth of 24 m. The company noted that Pamela Jean mineralisation has a flat lateritic surface 15-30 m below the ground surface but has a funnel-shaped base that reaches a depth of up to 165 m38.

In its 2018 Annual Report, Ardea noted that scandium is pervasive in the Goongarrie nickel-cobalt ore and that in the upper ore zone it is hosted by chrome-bearing mineralisation. In the lower ore zones, it is hosted by asbolite-bearing39 mineralisation. The company have indicated the potential for the addition of an Ion Exchange/Solvent Extraction unit to the proposed nickel-cobalt plant in order to recover the scandium40.

Kalpini Prospect: In August 2017, Ardea Resources Ltd reported that drilling aimed at obtaining data from less well-known areas between existing deposits had identified scandium in three separate regolith zones at its Kalpini nickel-cobalt project, about 60 km northeast of Kalgoorlie. The company said that scandium mineralisation usually occurs above the nickel-cobalt mineralisation and that mining of nickel-cobalt ore would necessitate removal of the scandium-enriched material. This may be an opportunity for the recovery of scandium from material with scandium grades that may not be adequate by themselves to support a mining operation. Further exploration is required. Scandium intersections included 20 m @ 102 g/t Sc and 6 m @ 463 g/t Sc41.

Mount Weld Mine: Lynas Corporation Ltd produces a rare-earth concentrate from the Mount Weld mine, 35 km south of Laverton, which is processed at the company’s Lynas Advanced Materials Plant at Kuantan, Malaysia. Lynas has commented that scandium oxide (Sc2O3) is present in the Mount Weld concentrates42 but there are no reported scandium resource estimates.

Mount Weld Prospect: Great Southern Mining Ltd acquired this prospect late in 2018. It is 28 km southeast of Laverton and is close to Lynas Corporation’s Mount Weld rare earths mine. Great Southern reported that an analysis of aircore drill samples collected by the previous owner identified thick scandium mineralised zones in a well-developed laterite with the scandium mineralisation occurring as a “blanket” above or coincident with a zone of cobalt mineralisation. Scandium drill intersections reported included 12 m @ 116 g/t Sc, 16 m @ 130 g/t Sc and 12 m @ 164 g/t Sc. Cobalt intersections included 4 m @ 0.02% Co, 12 m @ 0.19% Co and 8 m @ 0.04% Co43.

Mulga Rock Deposit: Vimy Resources Ltd’s Mulga Rock uranium project is located 290 km east-northeast of Kalgoorlie. The company has completed a positive DFS into the development of the uranium resource. In 2015, with the release of an increased uranium mineral-resource estimate for Mulga Rock, Vimy also reported resources for by-product base metals and scandium. The company noted that this mineralisation is associated with the uranium resources in the Princess and Ambassador mineralisation but that it is also known outside of the area of the uranium resource.

The Indicated and Inferred Resources were reported as 33.1 Mt @ 260 ppm Cu, 770 ppm Zn, 430 ppm Ni, 200 ppm Co and 25 ppm Sc44. Ore Reserves reported for the Mulga Rock project were 22.7 Mt @ 845 ppm U3O8 for a contained 42.3 million pounds U3O8. These were within total resources of 71.2 Mt @ 570 ppm U3O845.

The company’s prefeasibility study and DFS looked at the potential to establish a stand-alone, base-metal plant to treat tailings from the uranium plant. Although the DFS ultimately focussed only on uranium, the company, in 2018, announced that it would again examine the potential to recover base metals targeting specific metals for the battery industry namely copper, nickel, cobalt and zinc46. Scandium, although originally reported in the resource estimates, has not been commented on in recent announcements.

Quicksilver Project: Golden Mile Resources Ltd’s Quicksilver nickel-cobalt project is located 300 km southeast of Perth between Hyden and Lake Grace. The company reported nickel-cobalt-scandium intersections from its maiden drilling program on the Garard prospect. Intersections included: 16 m @ 1.73% Ni, 0.10% Co and 41 g/t Sc from a depth of 36 m; 12 m @ 0.58% Ni, 0.16% Co and 32 g/t Sc from 32 m and 55 m @ 63 g/t Sc from surface. The higher grade scandium mineralisation is located in a zone above the cobalt-rich mineralisation but anomalous scandium grades were returned in a significant number of holes throughout the entire oxide profile47.

Further activity at Quicksilver focussed on nickel and cobalt mineralisation with an initial nickel-cobalt resource announced in November 2018. A total Indicated and Inferred Resource of 26.3 Mt @ 0.64% Ni and 0.04% Co included a higher grade zone of 4.0 Mt @ 0.98% Ni and 0.05% Co48.

Citation

Bibliographical reference: Huleatt, M.B., 2019. Australian Resource Reviews: Rare Earth Elements 2019. Geoscience Australia, Canberra. http://dx.doi.org/10.11636/9781925848458

References

1 United States Government Federal Register, 2018. Final List of Critical Minerals 2018. A Notice by the Interior Department on 05/18/2018. Document 83 FR 23295.

2 United States Geological Survey, 2019. Mineral Commodity Summaries 2019. U.S. Geological Survey, 200 pp.

3 ibid.

4 Jervois Mining Ltd, 2012. ASX announcement 29 August 2012.

5 Jervois Mining Ltd, 2015. ASX announcement 19 August 2015.

6 Australian Mines Ltd, 2017. ASX announcement 31 October 2017.

7 Australian Mines Ltd, 2019. Quarterly Activities Report March 2019. ASX announcement 26 April 2019.

8 Australian Mines Ltd, 2019. ASX announcement 17 June 2019.

9 Collerina Cobalt Ltd, 2018. ASX announcement 19 June 2018.

10 Collerina Cobalt Ltd, 2018. ASX announcement 20 November 2018.

11 Scandium International Mining Corp, 2019. Annual Report 2018. United States Securities and Exchange Commission Form 10-K.

12 Douglas McKenna & Partners Pty. Ltd. 2003. Final Report on Exploration Licences 4964, 5185, 5315 Lake Innes, N.S.W. Nickel/Cobalt/Scandium Laterite Project for Jervois Mining Ltd, 10 July 2003.

13 Resources and Geoscience New South Wales, 2018. Cobalt and Scandium Opportunities in New South Wales, Australia. October 2018 pamphlet.

14 Hylea Metals Ltd, 2018. ASX announcement 27 June 2018.

15 Hylea Metals Ltd, 2018. ASX announcement 14 August 2018.

16 Douglas McKenna & Partners Pty. Ltd. 2003. Final Report on Exploration Licences 4964, 5185, 5315 Lake Innes, N.S.W. Nickel/Cobalt/Scandium Laterite Project for Jervois Mining Ltd, 10 July 2003.

17 Jervois Mining Ltd, 2018. ASX announcement 31 October 2008.

18 Scandium International Mining Corp., 2016. NI43-101 Technical Report, 15 April 2016.

19 ibid.

20 See Footnote 11.

21 Scandium International Mining Corp., 2019. Nyngan project – Mine Lease Status Update. News Release 22 April 2019.

22 Scandium International Mining Corp., 2019. Nyngan Project – New Mine Lease Application Filed. News Release 15 May 2019.

23 Platina Resources Ltd, 2018. ASX announcement 13 December 2018.

24 ibid.

25 Platina Resources Ltd, 2018. ASX announcement 16 August 2018.

26 See Footnote 21.

27 See Footnote 16.

28 MinRex Resources Ltd, 2018. ASX announcement 6 June 2018.

29 Clean Teq Holdings Ltd, 2017. ASX announcement 9 October 2017.

30 Clean Teq Holdings Ltd, 2018. ASX announcement 25 June 2018.

31 Australian Mines Ltd, 2018. ASX announcement 20 November 2018.

32 Australian Mines Ltd, 2019. ASX announcement 14 February 2019.

33 Australian Mines Ltd, 2019. ASX announcement 13 June 2019.

34 PGE = platinum group elements (Pd, Pt, Os, Ir, Ru, Rh).

35 Ardea Resources Ltd, 2017. ASX announcement 31 October 2017.

36 Ardea Resources Ltd, 2017. ASX announcement 10 November 2017.

37 Ardea Resources Ltd, 2018. ASX announcement 8 June 2018.

38 Ardea Resources Ltd, 2018. ASX announcement 8 October 2018.

39 Asbolite is mixed oxides of cobalt and manganese.

40 Ardea Resources Ltd, 2018. Annual Report 2018.

41 Ardea Resources Ltd, 2017. ASX announcement 22 June 2017.

42 Lynas Corporation Ltd, 2019. ASX announcement 22 May 2019.

43 Great Southern Mining Ltd, 2019. ASX announcement 18 March 2019.

44 Vimy Resources Ltd, 2015. ASX announcement 17 September 2015.

45 Vimy Resources Ltd, 2017. ASX announcement 4 September 2017.

46 Vimy Resources Ltd, 2018. ASX announcement 12 April 2018.

47 Golden Mile Resources Ltd, 2017. ASX announcement 30 August 2017.

48 Golden Mile Resources Ltd, 2018. ASX announcement 19 November 2018.