Niobium

Page last updated:19 December 2023

Please note that this page is currently under review.

Resource figures are current as at 31 December 2018.

Niobium (Nb) is a ductile refractory metal that is highly resistant to heat and wear. Like tantalum, it is resistant to corrosion owing to the formation of a surface oxide layer.

Approximately 90% of niobium use is attributed to the steel industry, predominantly as a micro alloy with iron. The addition of small, relatively cheap, amounts of niobium (much less than 1%) significantly increases the strength and decreases the weight of steel products. This results in more economic, beneficial products for use in the construction industry (e.g., beams in buildings, bridges, oil rigs, railway tracks), in gas and oil pipelines, and in the automotive industry where weight savings result in increased performance and fuel reduction.

Niobium, along with other refractory elements such as tantalum, is also used in nickel and nickel-iron superalloys, particularly for applications requiring strength and heat resistance. Uses for such superalloys include turbine blades in jet engines within the aeronautic industry, and gas turbines in the energy industry.

Niobium becomes a superconductor at very low temperatures. When alloyed with titanium (NbTi) or tin (Nb3Sn), it produces the superconducting magnets used in magnetic resonance imaging (MRI) scanners, nuclear magnetic resonance (NMR) equipment and particle accelerators such as the Large Hadron Collider at CERN1.

Other uses for niobium include: in glass for applications such as corrective spectacles and camera lenses; within jewellery; in prosthetics and medical implants; in niobium capacitors in electronic circuits; in sodium vapour lamps; and in cutting tools.

Niobium is one of a suite of commodities identified by the Australian Government as critical minerals2, i.e., minerals (or elements) considered vital for the well-being of the world's economies, yet whose supply may be at risk of disruption. Niobium is essential for advanced technology.

Niobium mineralisation in Australia

Niobium shares many of its properties with tantalum, which it is commonly found with. This close association has led to use of the 'coltan' terminology, short for columbite-tantalites, reflecting the niobium-dominant (columbite)3 and tantalum-dominant (tantalite) end-members of this oxide mineral series (see text box below). Despite this common terminology, most of the world's niobium resource is hosted within the mineral pyrochlore.

Australia's niobium resource is confined to a small number of deposits, largely as a by-product or co-product of rare earth element or rare earth element-zirconium mineralisation in peralkaline rocks and carbonatites. Examples of these include the Mount Weld carbonatite (Western Australia), the Toongi Trachyte, which is the peralkaline host for the mineralisation of the Dubbo Project (New South Wales) and the Brockman deposit (northern Western Australia).

Reported grades in these deposits range from 3100 to 3500 ppm (Toongi, Brockman) to 7400 ppm (Mount Weld). Reported host minerals for niobium and tantalum in these deposits include natroniobite at Dubbo4; columbite and yttrium-bearing rare earth niobates at Brockman5; and columbite, niobium-enriched titanium minerals (ilmenite, rutile) and pyrochlore at Mount Weld6.

Pegmatites form a minor host for Australia's niobium inventory, where it commonly occurs as a by-product with tantalum mineralisation, e.g., Greenbushes, Wodgina (both Western Australia). Where reported, niobium grades in these deposits are <100 ppm, generally similar to, or lower than, associated tantalum grades. Common niobium-tantalum minerals found in Australian pegmatites include columbo-tantalite, stibiotantalite, wodginite, ixiolite and microlite7.

Unlike tantalum grades, which are comparable in both peralkaline and pegmatite-hosted deposits, niobium grades, and hence niobium-tantalum (Nb/Ta) ratios, are quite distinct between and within deposit types. Nb/Ta ratios in the dominant lithium-caesium-tantalum pegmatites in the Pilbara are generally in the range of 0.1–2.37, considered low to very low, in the Wodgina pegmatites and 0.07–0.22 in the Mount Cassiterite pegmatites8. Recorded Nb/Ta ratios of 1.7–0.1 at Greenbushes9 and ~0.3 at Mount Deans (based on resource data) are an indication that the majority of lithium-tantalum pegmatites in the Yilgarn Craton also possess low Nb/Ta ratios. A small number of pegmatites in the Pilbara, the niobium-yttrium-fluorine family of pegmatites, are enriched in rare earth elements, uranium, thorium and niobium (over tantalum)10. Although the Nb/Ta ratios have not been reported, these pegmatites do have a distinctive mineralogy including the minerals fergusonite, samarskite and euxenite.

In contrast to pegmatites, Nb/Ta ratios in Australia's peralkaline deposits (largely based on reported grades) are much higher, with Nb/Ta ratios of 15-16 for Dubbo and Brockman11, and very high values of 37 to 44 for the rare earth element-rich Mount Weld deposit. However it is unknown if the high Nb/Ta ratio at Mount Weld is a primary feature or results from processes responsible for the weathered horizon that hosts the mineralisation.

Minor placer deposits (alluvial and elluvial) of tantalum and niobium minerals have been sporadically worked in Western Australia. These are predominantly close to known hard rock mineralisation, e.g., in the Pilbara region (Wodgina, Moolyella, Tabba Tabba areas) and in the Greenbushes area of the Yilgarn Craton, and are often associated with tin12.

JORC Ore Reserves

As at December 2018, Proved and Probable Ore Reserves of niobium reported in compliance with the JORC Code amounted to 58 kt (Table 1), all of which is from the Dubbo Project.

This figure is unchanged from 2017 but represents a significant decrease from 116 kt in 2016. This decrease was due to the reappraisal of the Dubbo deposit, largely reflecting revised operating costs, projected revenue and approved site layouts13. As of December 2018, Ore Reserves accounted for about 27% of Australia's Economic Demonstrated Resources (EDR)14 of niobium.

Apart from the 2017 reduction, Australian Ore Reserves of niobium have remained unchanged since 2011, reflecting the initial Ore Reserve definition at Dubbo. Reported Ore Reserves for the early and mid-2000's are from the Greenbushes pegmatite deposit, which were reported as Mineral Resources (not Ore Reserves) after 2007.

Table 1. Australia's Ore Reserves of niobium, 2002-2018.

| Year | Ore Reserve1 (kt Nb) |

|---|---|

| 2018 | 58 |

| 2017 | 58 |

| 2016 | 116 |

| 2015 | 116 |

| 2014 | 115 |

| 2013 | 115 |

| 2012 | 115 |

| 2011 | 115 |

| 2010 | 0 |

| 2009 | 0 |

| 2008 | 0 |

| 2007 | 21 |

| 2006 | 21 |

| 2005 | 21 |

| 2004 | 21 |

| 2003 | 21 |

| 2002 | 10 |

kt Nb = thousand tonnes of contained niobium.

- Ore Reserves in Proved and Probable categories. The majority of Australian Ore Reserves are reported in compliance with the JORC Code, however there are a number of companies that report to foreign stock exchanges using other reporting codes, which are largely equivalent. In addition, Geoscience Australia may hold confidential information for some commodities.

Identified Resources

At the end of December 2018, Australia's EDR of niobium were 216 kt, unchanged from 2017, and up marginally from 197 kt in 2016 (Table 2). Australia's EDR of niobium is attributable to two deposits: Dubbo in New South Wales (62%) and Brockman in Western Australia (38%). The 2016 to 2017 increase reflects a slight upgrade in the Dubbo resource.

Since 2007, EDR has increased a number of times, reflecting definition of Measured and Indicated Mineral Resources at Dubbo and Brockman. Over this period (2007-2018), world economic resources of niobium, as reported by the United States Geological Survey (USGS), has almost quadrupled, with a doubling from 2017 to 2018 alone15.

Australia had 15 kt of niobium considered subeconomic (paramarginal) at the end of 2017, unchanged from 2016 (Table 2). Inferred Resources of niobium in 2017 and 2018 (397 kt) were down marginally from 2016 (418 kt; Table 2), again largely reflecting the change in category of resources at the Dubbo deposit.

Accessible EDR

Some mineral resources are inaccessible for mining because of environmental restrictions, government policies or because they occur within military lands or national parks. All of Australia's EDR of niobium are considered to be accessible (Table 2).

Table 2. Australia's identified niobium (kt Nb) resources and world figures for selected years, 1990-2018.

| Year | Demonstrated Resources | Inferred Resources3 | Accessible EDR4 | Australian Mine Production5 | World Economic Resources6 | World Mine Production6 | ||

|---|---|---|---|---|---|---|---|---|

| Economic (EDR)1 | Subeconomic2 | |||||||

| Paramarginal | Submarginal | |||||||

| 2018 | 216 | 15 | 0 | 397 | 216 | 9120 | 64 | |

| 2017 | 216 | 15 | 0 | 397 | 216 | 4500 | 64 | |

| 2016 | 1977 | 15 | 0 | 418 | 1977 | 4500 | 64 | |

| 2015 | 1977 | 15 | 0 | 418 | 1977 | 4500 | 56 | |

| 2014 | 1157 | 82 | 418 | 1157 | 4300 | 59.4 | ||

| 2013 | 1157 | 82 | 418 | 1157 | 4300 | 51 | ||

| 2012 | 1157 | 82 | 148 | 1157 | 4300 | |||

| 2011 | 1157 | 82 | 418 | 1157 | 3000 | 63 | ||

| 2010 | 1157 | 15 | 419 | 1157 | 2900 | 63 | ||

| 2009 | 115 | 15 | 543 | 115 | 2900 | 62 | ||

| 2008 | 115 | 157 | 5437 | 115 | 2700 | 60 | ||

| 2007 | 40 | 1297 | 5437 | 40 | 2700 | 45 | ||

| 2006 | 194 | 129 | 389 | 194 | 4400 | 59.9 | ||

| 2005 | 194 | 129 | 389 | 194 | 4392 | 33.9 | ||

| 2000 | 29 | 29 | 132 | 1996 | 29 | 3500 | 23.6 | |

| 1995 | 3.4 | 67.6 | 1994 | 3.4 | 3500 | 13.5 | ||

| 1990 | 3.4 | 31 | 2014 | 3.4 | 3538 | 13.4 | ||

kt Nb = thousand tonnes of contained niobium.

- Economic Demonstrated Resources (EDR) predominantly comprise Ore Reserves and most Measured and Indicated Mineral Resources that have been reported in compliance with the Joint Ore Reserves Committee (JORC) Code to the Australian Securities Exchange (ASX). In addition, some reserves and resources may have been reported to foreign stock exchanges using other reporting codes, which are largely equivalent to the JORC Code. Geoscience Australia may also hold some confidential data.

- Subeconomic Demonstrated Resources are geologically demonstrated but do not meet the criteria for economic at the time of determination. Subeconomic resources classed as Paramarginal require a modest improvement in the commodity price/cost ratio to render them economic. Subeconomic resources classed as Submarginal require a substantially improved commodity price/cost ratio to render them economic.

- Total Inferred Resources in economic, subeconomic and undifferentiated categories.

- Accessible Economic Demonstrated Resources (AEDR) is the portion of total EDR that is accessible for mining. AEDR does not include resources that are inaccessible for mining because of environmental restrictions, government policies or military lands. All of Australia's niobium resources are considered accessible.

- Australian mine production is not available; it is possible that niobium is produced as a by-product at some lithium-tantalum operations.

- Source: United States Geological Survey (Mineral Commodity Summaries). Resource numbers for niobium for the last few years are reported as a minimum value.

- Resource figures updated from previous estimates.

Production

There has been no reported production of niobium in Australia for 2018, although minor by-product niobium may have been produced as part of lithium and/or tantalum production from lithium-pegmatite mines in Western Australia.

World Ranking

World niobium and tantalum resources are poorly reported. Central Africa is known to host major resources but dependable resource estimates are rarely available. According to world estimates published by the USGS16, and supplemented with Australian figures, Australia's niobium resources are minor, accounting for about 4% of global niobium resources in 2018. This places Australia third in the world for reliably reported economic resources behind Brazil, Canada and followed by the USA. The USGS also indicates that global niobium resources are predominantly contained within carbonatites17.

World production of contained niobium was estimated by the USGS to be approximately 68 kt in 2018 (Table 2), again dominated by Brazil (88%), followed by Canada (10%)18.

Industry Developments

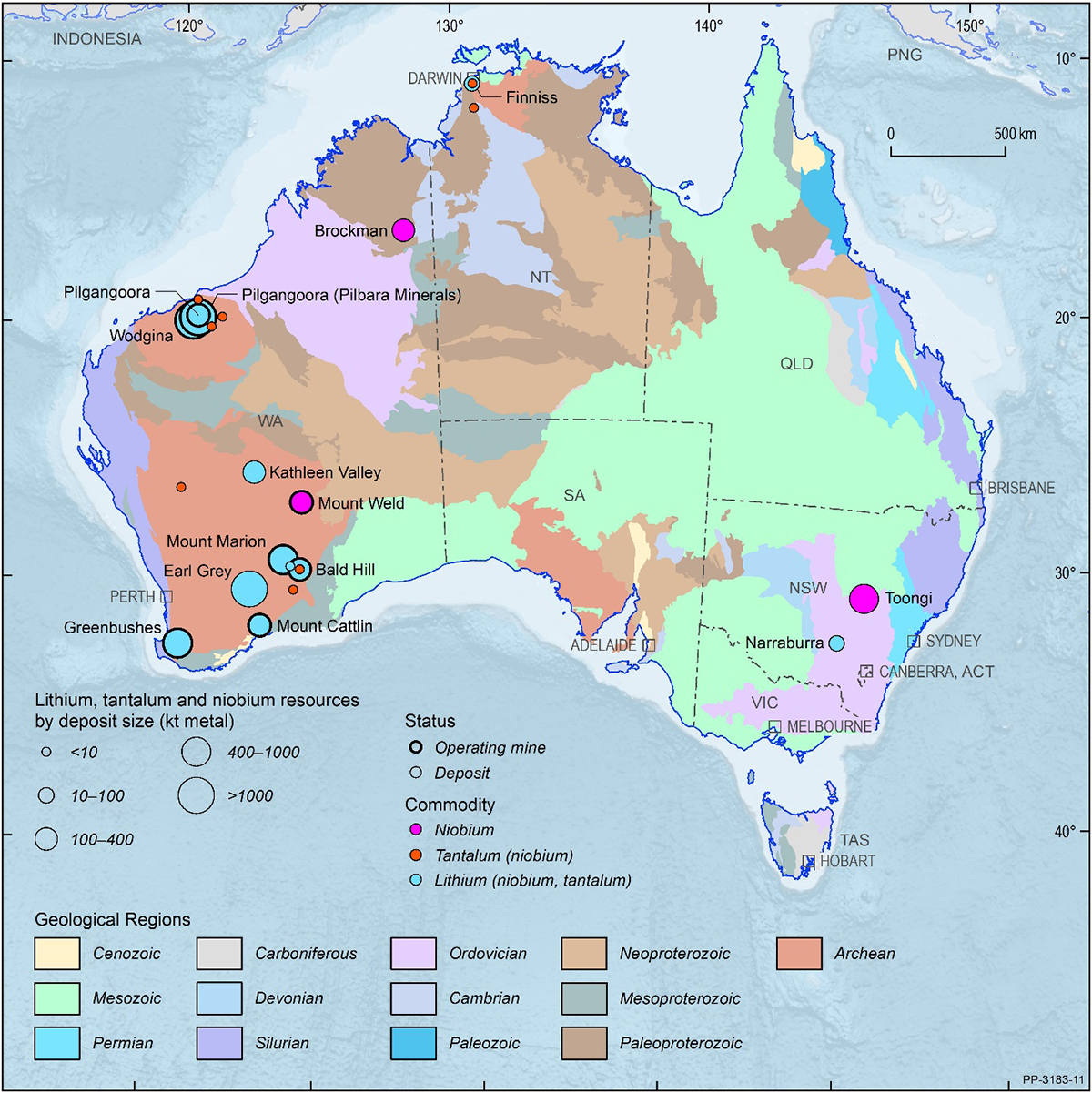

Niobium resources occur in Western Australia and New South Wales (Figure 1). This section highlights recent company resource estimates and development-related activities. All reported reserves and resources are compliant with the JORC Code unless otherwise stated.

Figure 1. Australian lithium, tantalum and niobium deposits and operating mines 2018.

kt metal = thousand tonnes of contained lithium, tantalum or niobium. Deposit size is based on total resources (EDR + Subeconomic Resources + Inferred). For clarity, only major or significant deposits are labelled.

Exploration

Within Australia, niobium exploration is supplementary to commodities of interest, e.g., rare earth elements, zirconium and tantalum. Additions in the last five years to Australia's niobium resources have largely reflected re-categorisation of resources at Dubbo and Brockman. There has been no additions from new deposits.

Alkaline rock-associated deposits

The majority of Australia's niobium Mineral Resources and all current Ore Reserves occur within deposits associated with peralkaline igneous rocks or carbonatites—Dubbo, Mount Weld and Brockman.

Dubbo: The Dubbo Project (owned by Alkane Resources Ltd through its subsidiary Australian Strategic Materials Ltd), is located 25 km south of Dubbo, New South Wales. The deposit, known as Toongi, is hosted in the Toongi Trachyte, a peralkaline volcanic or shallow intrusive body of Jurassic age.

The Toongi deposit is multi-commodity comprising zirconium, hafnium, niobium and rare earth elements, with potential by-product tantalum and yttrium. Ore elements are largely hosted in very fine-grained complex (Na-Ca-Zr-Hf-HREE) silicate phases, though most niobium and tantalum are in the mineral natroniobite19. Extraction of zirconium, hafnium, niobium and rare earths from the ore and from each other is metallurgically complex, but has been successfully confirmed at a pilot demonstration plant at the Australian Nuclear Science and Technology Organisation in Sydney (ANSTO)20. Niobium is extracted with the tantalum.

In 2019, Alkane republished the Dubbo Project's Mineral Resource estimates of 75.18 Mt at 1.89% ZrO2, 0.04% HfO2, 0.44% Nb2O5, 0.03% Ta2O5, 0.88% TREO (including Y2O3), of which 42.81 Mt at 1.89% ZrO2, 0.04% HfO2, 0.45% Nb2O5, 0.03% Ta2O5, 0.88% TREO in the Measured Resource category21. The latter includes Proved Ore Reserves of 18.90 Mt at 1.85% ZrO2, 0.04% HfO2, 0.44% Nb2O5, 0.03% Ta2O5, and 0.87% TREO. The total resource includes 234 kt of contained niobium and 18.7 kt of tantalum.

Currently, the project is at an advanced stage, being construction-ready, subject to financing, with all key state and federal approvals in place. Definitive feasibility studies were undertaken in 201122 (400 kt per annum throughput) and 201323 (1 million tonnes per annum (Mtpa) throughput), followed by an Engineering Design study in mid-201524. The Mining Lease was granted in late 2015.

The company undertook additional studies, especially with regards to modularisation to reduce initial capital costs, culminating in the mid-2018 Engineering and Financials Update25. The 2018 report suggests that the project has an estimated initial mine life of approximately 20 years based on a 1 Mtpa plant, with considerable multi-decade expansion potential.

Two options were considered: either the originally-planned single 1 Mtpa plant or a modular two-stage development of two 500 ktpa plants, with the second plant to be built four to five years after the first becomes operational. The first option is more economical but the latter option allows for lower initial capital expenditure. Work is continuing on investigating/reviewing the two-stage strategy and project financing.

Brockman: The Brockman Project (originally Hastings), is situated 18 km southeast of Halls Creek in Western Australia, and is owned by Hastings Technology Metals Ltd. Hastings acquired the project in 2010, although earliest exploration dates back to the 1980s.

The deposit is hosted within the Niobium Tuff, a peralkaline volcaniclastic unit within the Brockman Volcanics. Mineralisation comprises REE, niobium and zircon with associated tantalum, occurring as very fine-grained minerals. Niobium (and tantalum) are hosted in columbite and samarskite26. Hastings have undertaken metallurgical test work on the project, in conjunction with ANSTO, demonstrating the feasibility of separating the ore elements27, reinforcing earlier (1980s) metallurgical work by previous owners West Coast Holdings Ltd28. West Coast, who were focussed on niobium and zirconium, processed 100 t of ore through a pilot plant in the United Kingdom29.

The most recent (2015) resource figures for Brockman indicate a total Mineral Resource of 41.4 Mt at 0.21% REO, 0.36% Nb2O5 and 0.90% ZrO2, for a contained 103.6 kt of niobium30. The tantalum content, based on the tantalum grade of 182 ppm reported in the previous (2011) resource estimate31, is approximately 6.1 kt. The deposit has seen minimal focus over the last few years, with the company prioritising their rare earth Yangibana Project, also in Western Australia.

Mount Weld: The Mount Weld rare earths deposit, 240 km north-northeast of Kalgoorlie, is owned by Lynas Corporation Ltd. The main focus of the deposit and current mine is the REE mineralisation, which occurs within a secondary, phosphate-rich regolith horizon formed above the Mount Weld carbonatite32. The deposit also locally hosts niobium-tantalum and phosphate mineralisation.

Niobium and tantalum mineralisation are hosted in a distinct zone of the deposit—the niobium-rich rare metals resource (also known as the Crown deposit). This resource, defined separately from the main rare-earth resource, has a total Mineral Resource of 37.7 Mt at 1.07% Nb2O5, 0.024% Ta2O5, 0.30% ZrO2, 8.0% P2O5, 1.16% REO and 0.09% Y2O3, with a contained 280 kt of niobium and 7.6 kt of tantalum33. All but 1.5 Mt are in the Inferred category. The niobium-tantalum mineralisation was the subject of an early scoping study looking at producing 1 Mtpa of ore34. There are no indications of when, or if, this resource will be mined.

Pegmatite-hosted deposits

Minor niobium resources have been previously reported in association with tantalum at a number of Western Australia's lithium-tantalum, hard-rock pegmatite deposits, including Greenbushes35 and Wodgina36. No current figures have been reported.

Based on reported Nb/Ta ratios, these deposits are likely to have niobium contents similar to, or less than, tantalum contents. Further description of these tantalum-bearing pegmatite deposits are provided in the tantalum report37 of the Australian Resource Review series.

Citation

Bibliographical reference: Champion, D., 2020. Australian Resource Reviews: Niobium 2019. Geoscience Australia, Canberra.

References

1 The European Organization for Nuclear Research.

2Australia's Critical Mineral Strategy 2019, Australian Government, Canberra, 22pp.

3 Niobium, when first discovered was named columbium.

4 Alkane Resources Ltd. Presentation. ASX release 10 November 2015.

5 Ramsden, A.R., French, D.H. and Chalmers, D.I., 1993. Volcanic-hosted rare-metals deposit at Brockman, Western Australia. Mineralium Deposita 28, 1-12.

6 Lottermoser, B.G., 1990. Rare-earth element mineralisation within the Mt Weld carbonatitic laterite, Western Australia. Lithos 24, 151-167.

7 Melcher, F., Graupner, T., Gabler, H-E, Sitnikova, M., Oberthur, T. Gerdes, A, Badanina, E. and Chudy, T., 2017. Mineralogical and chemical evolution of tantalum–(niobium–tin) mineralisation in pegmatites and granites. Part 2: Worldwide examples (excluding Africa) and an overview of global metallogenetic patterns. Ore Geology Reviews 89, 946-987.

8 Sweetapple, M.T. and Collins, P.L.F., 2002. Genetic framework for the classification and distribution of Archean rare metal pegmatites in the north Pilbara Craton, Western Australia. Economic Geology 97, 873-895.

9 Partington, G.A., McNaughton, N.J. and Williams, I.S., 1995. A review of the geology, mineralization and geochronology of the Greenbushes pegmatite, Western Australia, Economic Geology 90, 616-635.

10 See footnote 7.

11 See footnote 4.

12 Fetherston, J.M., 2004. Tantalum in Western Australia. Western Australia Geological Survey, Mineral Resources

Bulletin 22, 162p.

13 Alkane Resources Ltd. ASX Release 19 September 2017.

14 Economic Demonstrated Resources (EDR) is the category with the highest economic feasibility and geological assurance in the National Classification System for Identified Mineral Resources. It predominantly comprises Proved and Probable Ore Reserves and most Measured and Indicated Mineral Resources that have been reported in compliance with the JORC Code. In addition, EDR may contain some reserves and resources that have been reported using other reporting codes and include confidential data.

15 United States Geological Survey. Mineral Commodity Summaries, 2008-2019.

16 United States Geological Survey. Mineral Commodity Summaries 2019.

17 ibid.

18 ibid.

19 Alkane Resources Ltd. Presentation. ASX release 10 November 2015.

20 Alkane Resources Ltd. ASX Release 11 April 2013.

21 Alkane Resources Ltd. Annual Report 2019.

22 Alkane Resources Ltd. ASX Release 19 September 2011.

23 Alkane Resources Ltd. ASX Release 11 April 2013.

24 Alkane Resources Ltd. ASX Release 27 August 2015.

25 Alkane Resources Ltd. ASX Release 4 June 2018.

26 Ramsden, A.R., French, D.H. and Chalmers, D.I., 1993. Volcanic-hosted rare-metals deposit at Brockman, Western Australia. Mineralium Deposita 28, 1-12.

27 Hastings Rare Metals Ltd. Brockman Project History web page (https://hastingstechmetals.com/projects/brockman/project-history/).

28 ibid.

29 ibid.

30 Hastings Rare Metals Ltd. ASX Release 29 January 2016.

31 Hastings Rare Metals Ltd. ASX Release 8 September 2011.

32 Lottermoser, B.G., 1990. Rare-earth element mineralisation within the Mt Weld carbonatitic laterite, Western Australia. Lithos 24, 151-167.

33 Lynas Corporation Ltd. Annual Report 2019.

34 ibid.

35 Behre Dolbear Australia Pty Ltd, 2012. NI 43-101 Technical Report, TSX release 21 December 2012.

36 Sweetapple, M.T. and Collins, P.L.F., 2002. Genetic framework for the classification and distribution of Archean rare metal pegmatites in the north Pilbara Craton, Western Australia. Economic Geology 97, 873-895.

37 Champion, D., 2020. Australian Resource Reviews: Tantalum 2019. Geoscience Australia, Canberra.