Australia's Energy Commodity Resources 2025 Hydrogen

Page last updated:23 October 2025

Hydrogen

|

TDR 8 PJ1 (-) | |

|

Clean hydrogen production capacity2 697 t/yr ( 52%) (operational) |

|

Major Projects 69 announced ( 9%) - 6 under construction - 63 in feasibility and under development |

|

Production Currently in the pilot and small demonstration phase, with larger demonstration scale projects under construction. |

Notes

Statistics as of December 2024; 1natural hydrogen resources; 2from electrolysis, biomass and fossil fuel conversion with carbon capture and storage; TDR = Total demonstrated resources (reserves and contingent resources); t/yr= tonnes per year. Percentage increases or decreases are in relation to 2023, – = no change.

Highlights

- The revised 2024 National Hydrogen Strategy was released, introducing hydrogen production targets and focussing on key hard-to-abate sectors of the economy.

- Clean hydrogen in Australia is moving from pilot and small demonstration-scale projects to the construction of larger demonstration-scale projects.

- Renewable hydrogen production in Australia increased by 52% over the year, although starting from a relatively low base.

- The number of major hydrogen projects under consideration in Australia decreased from 76 in 2023 to 69 in 2024, reflecting increased costs and a more mature understanding of hydrogen’s role in the energy transition.

Australian and International hydrogen targets

The Australian Government released the 2024 National Hydrogen Strategy in September 2024 and provides a thorough update of the former Hydrogen Strategy published in 2019. This new strategy focusses on the growth of a clean hydrogen industry and aims to position Australia as a global leader in the production, use and export of hydrogen derivatives such as ammonia and hydrogen-imbedded products such as green iron. There is increasing focus on hard-to-abate sectors of the economy such as iron, alumina, fertilizers, heavy road freight and long-haul transport (e.g. aviation and shipping). These industries are currently heavily reliant on fossil fuels and cannot be easily electrified.

A key component of the updated Strategy is the introduction of production incentives under the Government's Future Made in Australia plan, announced in the 2024–25 Federal Budget. These incentives, including the Hydrogen Production Tax Incentive (HPTI) and the expanded Hydrogen Headstart Program, are designed to accelerate investment, promote economies of scale and reduce the cost gap for renewable hydrogen.

Box 6.1 Methods for producing clean hydrogen

There are two primary methods currently available for producing clean hydrogen:

- using renewable energy sources such as solar and wind power to split hydrogen from water using a process known as electrolysis; and,

- through a thermochemical reaction using water and fossil fuel feedstocks such as coal (coal gasification) or natural gas (steam methane reforming), with the CO2 emissions created as a by-product captured and stored in deep subsurface geological formations.

The majority of hydrogen produced globally is derived from fossil fuels without carbon capture and storage, with China, the United States and the Middle East accounting for more than half of total global production (IEA, 2024). Currently, global production of clean hydrogen remains below 1 Mt per annum (Mtpa), which accounts for less than 1% of all hydrogen production in 2024 (IEA, 2024). Despite a number of project cancellations during 2024, global investment in clean hydrogen rose by 60% in 2024, and there remains a large pipeline of hydrogen production projects that have received their Financial Investment Decision (IEA, 2025). In Australia, the 2024 National Hydrogen Strategy set a minimum target for clean hydrogen production of 0.5 Mtpa by 2030 and 15 Mtpa by 2050.

Australia’s hydrogen potential

Australia is well placed to become a major hydrogen producer for both domestic consumption and export. Australia has significant capacity for renewable energy generation, as well as abundant identified resources of natural gas and coal, and potential large-scale geological storage sites for any co-produced CO2. While most projects underway are still in the feasibility or engineering stages, a few hydrogen projects with capacities greater than 10 MW are progressing into construction, with production expected to commence in 2025 and 2026 (CSIRO, 2025).

- Investment from Australian state/territory and federal governments is increasing, with $17.5 billion of committed hydrogen specific support and $42.8 billion of hydrogen eligible support through a range of programs, including the National Reconstruction Fund (CSIRO, 2024; DCCEEW, 2024).

Geoscience Australia provides open access to datasets and digital tools to assist governments and industry assess Australia’s hydrogen potential. The Hydrogen Economic Fairways Tool (HEFT), released in 2021, conducts detailed geospatial-economic analysis of future large-scale hydrogen projects and considers hydrogen produced by renewable energy and from fossil fuels with CCS. This supports policymakers and investors in their decision making regarding the location of new infrastructure and the suitability of various regions for hydrogen production.

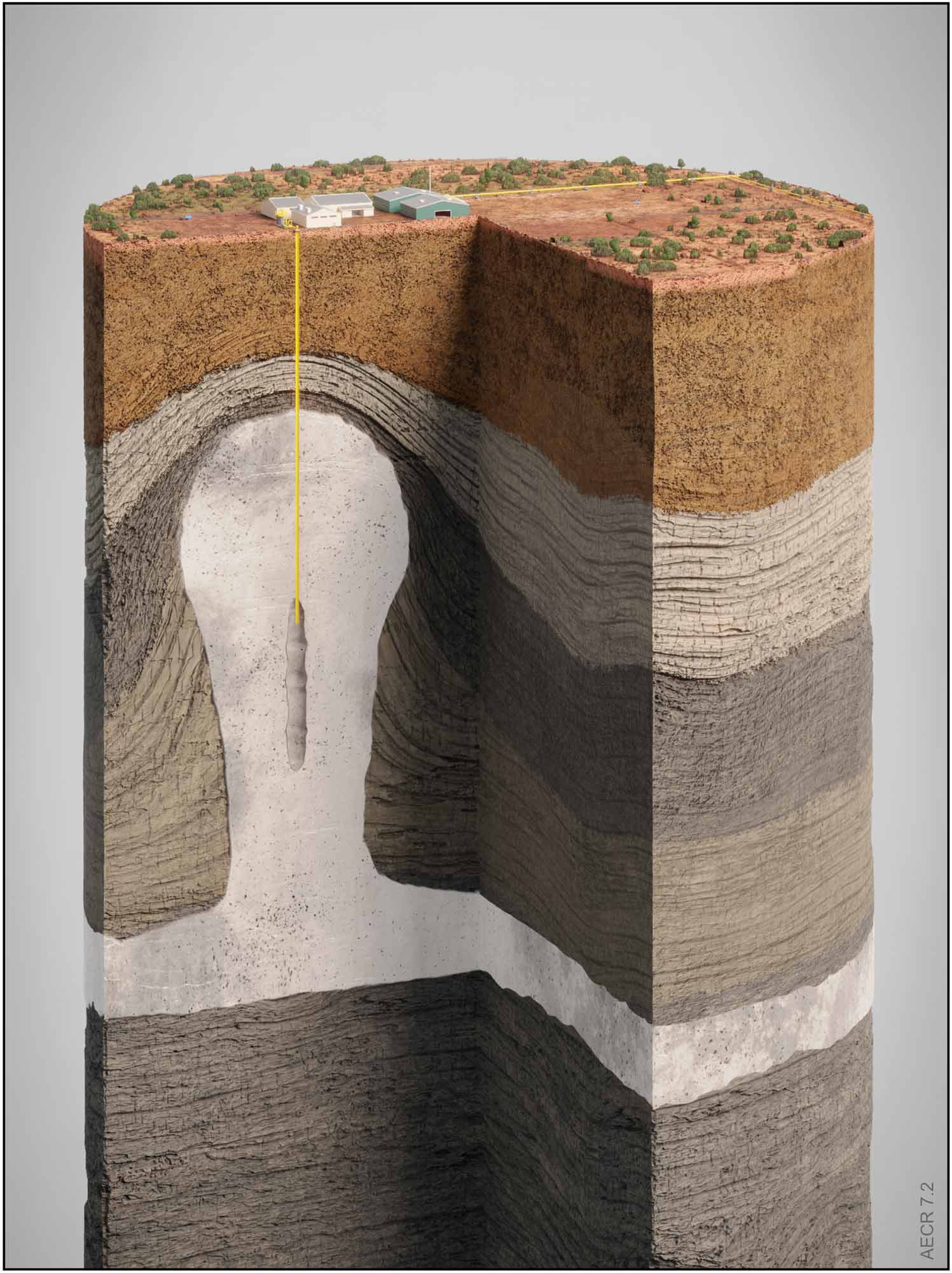

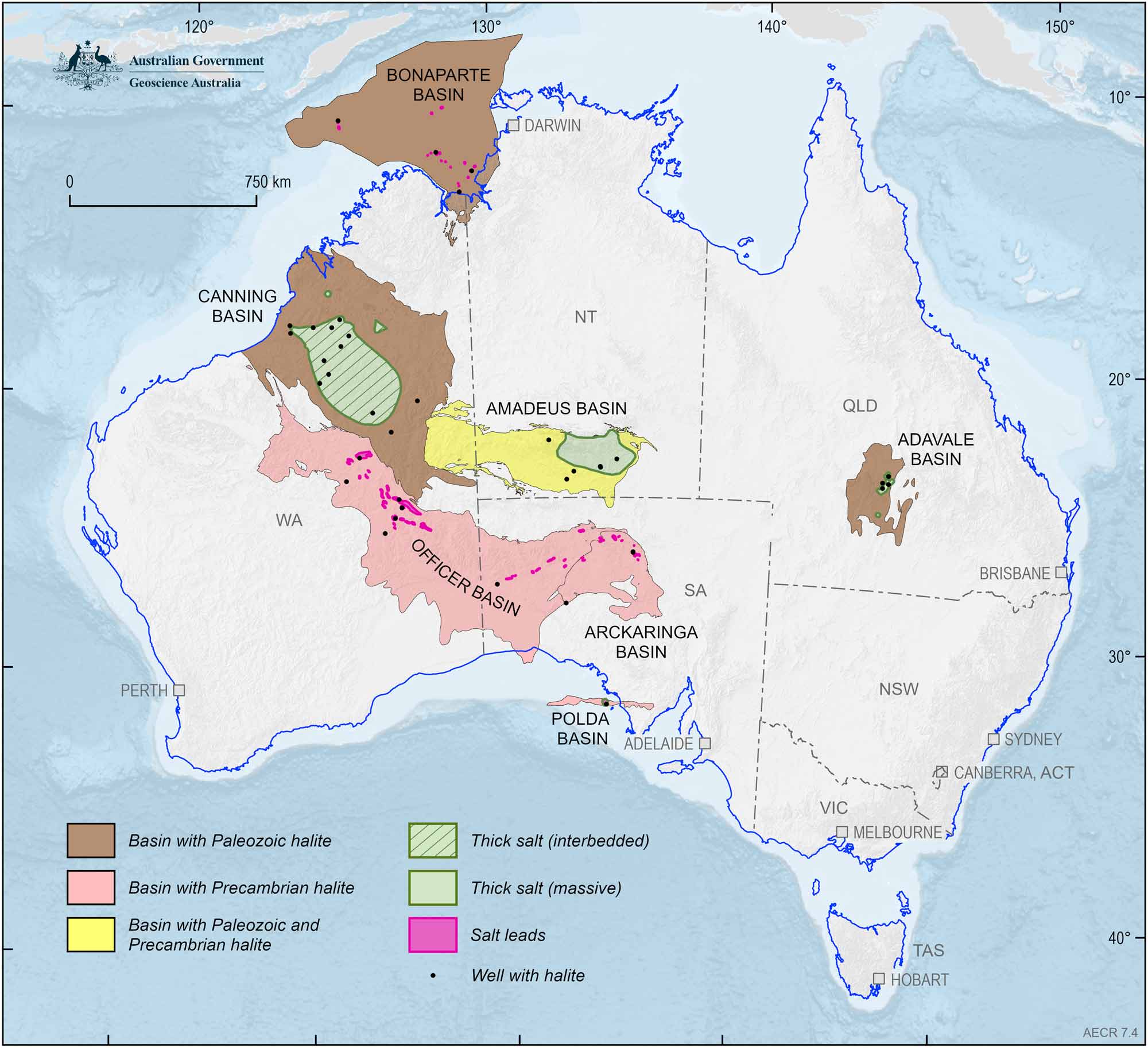

Storage infrastructure is essential to enable hydrogen to be produced and stored during periods of low demand, then supplied during periods of high consumption. Small quantities of hydrogen can be stored in pipelines or tanks above ground. Large-scale storage of hydrogen occurs in subsurface salt caverns (Figure 7.2), although there is potential for storage in depleted gas fields or lined, mined hard rock caverns. Geoscience Australia has mapped the known distribution of thick underground rock salt accumulations (Figure 7.3, Figure 7.4; Bradshaw et al., 2023). Regions with thick salt that may be prospective for salt cavern construction include the Adavale Basin, the Amadeus Basin, the Polda Basin and the Bonaparte Basin offshore Northern Territory. Parts of the Canning and Officer basins may also contain suitable salt (Figure 7.3, Figure 7.4). Geoscience Australia is undertaking further work under the Resourcing Australia’s Prosperity initiative to assess the most suitable storage options for large scale hydrogen.

Australia’s hydrogen projects

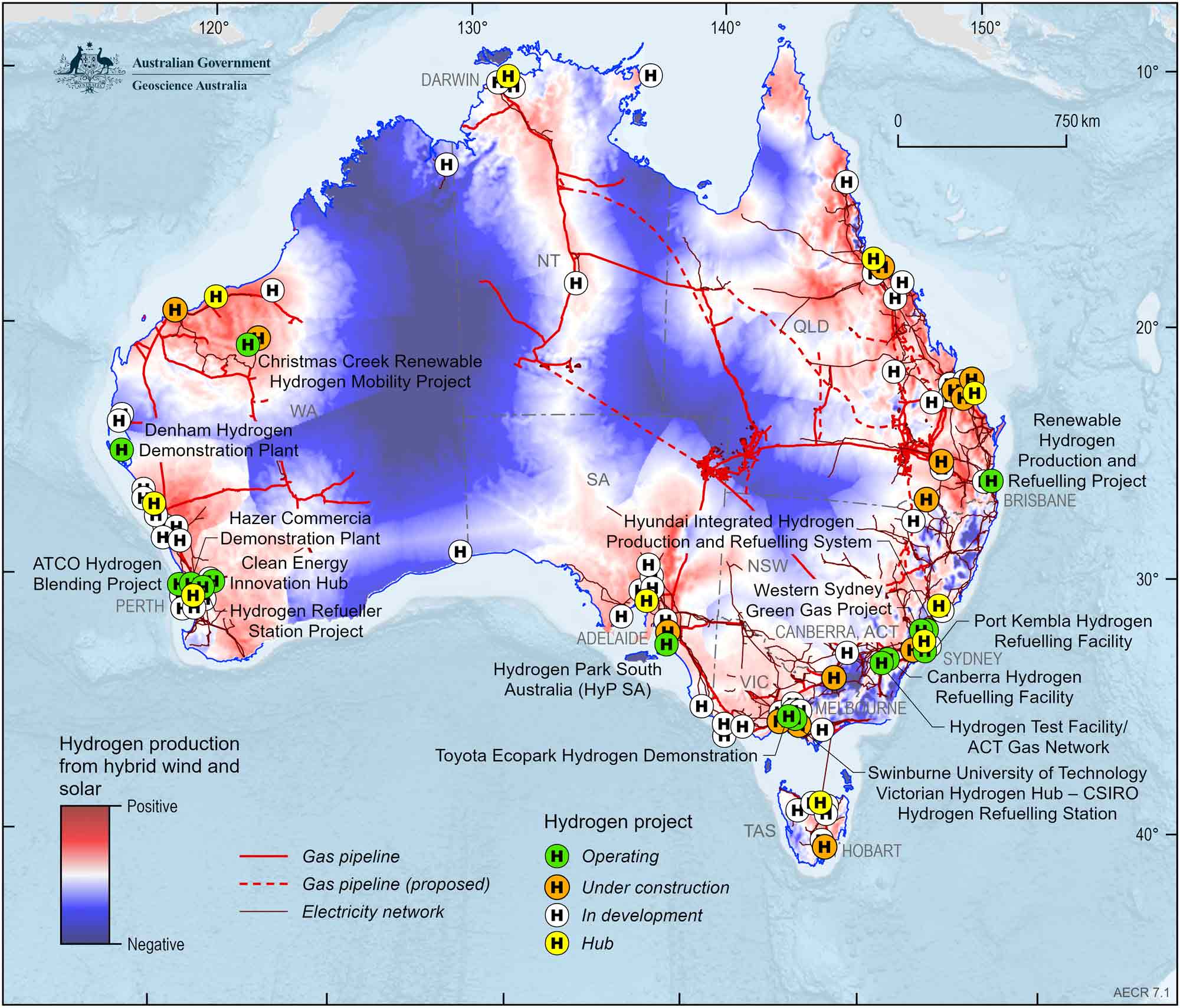

There are several pilot, demonstration and small-scale projects in various stages of operation in Australia. Figure 7.1 shows the location of current hydrogen projects in Australia (as of December 2024) compiled by CSIRO’s HyResource and the results of a mapping scenario using the HEFT tool that considers hydrogen production from electrolysis and hybrid wind and solar. In 2024, there was a decrease in the total number of hydrogen projects from 104 in 2023 to 90 as expectations around hydrogen’s role in the energy transition have matured. The number of projects that are operational or under construction remain steady, going from 31 in 2023 to 30 in 2024. The combined production capacity of these projects (currently operational or under construction) is estimated at approximately 11.5 kt (1.38 PJ) per year (CSIRO, 2025). Project sizes are still relatively modest with Christmas Creek Renewable Hydrogen Mobility Project being the largest operating project, producing 193 tonnes per year from electrolysis using hybrid solar and gas energy. In terms of major projects, the total number of hydrogen projects under consideration has contracted from 76 in 2023 to 69 in 2024 (DISR, 2024).

Natural hydrogen

Australia is one of the most prospective countries for natural (geogenic) hydrogen. The extent of this geological resource is not well understood, but there are several reports of high concentrations of hydrogen in gas samples in Australia (Boreham et al., 2021). Interest in natural hydrogen is increasing and some Australian state jurisdictions have started to amend their petroleum exploration licences to include natural hydrogen. Interest intensified in 2023 with the drilling of Australia’s first dedicated natural-hydrogen wells, Ramsey 1 and Ramsey 2, on the Yorke Peninsula, South Australia. Targeting historic hydrogen shows from a 1931 bore, the wells reported high purity hydrogen (up to 86%) and notable helium (up to 6.8%), with further testing confirming the results in 2024 (Gold Hydrogen, 2023a, 2023b). In 2024, the only contingent (2C) natural hydrogen resource reported was in the Amadeus Basin, Central Petroleum’s Mt Kitty project with 7.9 PJ (22 Bcf), unchanged from the previous year (Table 7.1).

Table 7.1 Australia's reported natural hydrogen resources in 2024

| Basin | Project | Hydrogen | Data source | |

|---|---|---|---|---|

| 2C Resources (PJ) | 2C Resources (Bcf) | |||

| Amadeus Basin | Mt Kitty | 7.9 | 22 | Central Petroleum Limited (2024) |

| Total | 8 | 22 | ||

Abbreviations

PJ= petajoules; Bcf = billion cubic feet.

References

AEMO (Australian Energy Market Operator), 2025. NEM Generation Information July 2025 . (Last accessed August 2025)

Boreham C.J., Edwards D.S., Czado K., Rollet N., Wang L., van der Wielen S., Champion D., Blewett R., Feitz A., Henson P.A. 2021. Hydrogen in Australian natural gas: occurrences, sources and resources. The APPEA Journal 61, 163-191.

Bradshaw M., Rees S., Wang L., Szczepaniak M., Cook W., Voegeli S., Boreham C., Wainman C., Wong S., Southby C., Feitz A. 2023. Australian salt basins – options for underground hydrogen storage. The APPEA Journal 63, 285-304.

Central Petroleum Limited, 2024. 2024 Annual Report.

Commonwealth of Australia 2019. Australia’s National Hydrogen Strategy.

CSIRO (Commonwealth Scientific and Industrial Research Organisation), 2024. HyResource - Funding. (Last accessed August 2025).

CSIRO (Commonwealth Scientific and Industrial Research Organisation), 2025. HyResource Projects spreadsheet, updates 11 August 2025. (Last accessed August 2025)

DCCEEW (Department of Climate Change, Energy, the Environment and Water), 2022. State of Hydrogen, 2022

DCCEEW (Department of Climate Change, Energy, the Environment and Water), 2024. National Hydrogen Strategy 2024.

DISR (Department of Industry, Science and Resources), 2024. Resources and Energy Major Projects 2024 Report.

Gold Hydrogen, 2023a. Significant Concentrations of Hydrogen and Helium Detected in the Ramsay 1 Well, 31 October 2023.

Gold Hydrogen, 2023b. Ramsay 2 Update Very High Hydrogen Concentrations up to 86% Purity Found Along with the Very High Helium Concentrations, 19 December 2023.

IEA (International Energy Agency) 2024. Global Hydrogen Review 2024. IEA, Paris.

IEA (International Energy Agency) 2025. World Energy Investment 2025. 10th Edition. IEA, Paris.

Data download

Data tables and full report are downloadable from the Geoscience Australia website.