Australia's Energy Commodity Resources 2025 Production and trade

Page last updated:23 October 2025

The outlook for Australian energy production from gas, oil, coal and uranium is tied to global trends in demand, supply and pricing. This section provides an overview of Australia’s energy production and trade during the 2022-23 financial year. It draws on the data and information published in the Australian Energy Update (DCCEEW, 2024), together with Resources and Energy Quarterly data published by the Office of the Chief Economist (DISR, 2024). The statistics from the Australian Energy Update 2024, cover the first complete reporting period unaffected by the disruptions to energy supply and trade associated with the COVID-19 pandemic.

Highlights for 2022–23:

- Australia continued to be a net exporter of energy commodities, with total exports more than seven times total imports (Table 2.1).

- Australia’s energy commodity export earnings continued to grow, reaching a record A$238.7 billion, up 17% on the previous year, mostly due to significant increases in earnings from LNG and thermal coal (Table 2.2). This growth was despite declines in total export volumes for all commodities.

- Australia maintained its position as one of the world’s largest LNG exporters, ranking third behind Qatar and the US. Approximately 73% of all natural gas produced in Australia was exported and LNG exports remained near record levels, decreasing slightly (2.1%) to 4,541 PJ.

- Australia mainly exports light, sweet oils (oil with a low sulfur content) from the North West Shelf to Asian refineries. In 2022–23, 96% of crude oil and condensate was exported, dropping 3% to 604 PJ due to reduced output from LNG facilities (DCCEEW, 2024). LPG exports also fell, declining 19.5% to 120 PJ. Export earnings were A$13.2 billion for crude oil and condensate (down 6%) and A$1.6 billion for LPG (up 6.1%).

- Australia relies heavily on imports for crude oil and refined petroleum products. In the 2022–23 period, total imports reached 2,188 PJ, reflecting a 17.4% rise in refined product imports and a 6.3% decrease in crude oil imports.

- Black coal (metallurgical and thermal) is Australia’s largest energy product and export, however in 2022‑23 exports and production both fell, down 5.6% and 3.9% respectively. Despite this, black coal export values continued to grow (up 12%), reaching a record A$127.4 billion, as a result of increased thermal coal prices.

- Australia is a significant exporter of uranium oxide for use in nuclear power plants. Uranium production increased by 30.9% to 2,760 PJ in 2022–23, however exports contracted slightly (2.5%) to 2,260 PJ. This follows declines in exports and production in 2020–21 and 2021–22 due to the closure of the Ranger Mine in 2021.

Table 2.1 Australian energy production, exports and imports by fuel type during the 2022–2023 financial year

| Energy source | Production | Exports | Imports | |||||||

|---|---|---|---|---|---|---|---|---|---|---|

| Petajoules | Share (%) | Growth 2022–23 (%) | Petajoules | Share (%) | Growth 2022–23 (%) | Petajoules | Share (%) | Growth 2022–23 (%) | ||

| Black coal | 10,784 | 50 | -3.9 | 9,606 | 56 | -5.6 | -- | -- | -- | |

| Brown coal | 401 | 2 | -3.6 | -- | -- | -- | -- | -- | -- | |

| Coal by-products | -- | -- | -- | 20 | 0.1 | -10.9 | 17 | 0.7 | 24.2 | |

| Natural gas/LNG | 6,200 | 29 | 0.8 | 4,541 | 26 | -2.1 | 48 | 2 | -14.6 | |

| Crude Oil and NGL | 626 | 3 | -13.4 | 604 | 4 | -3.0 | 362 | 16 | -10.8 | |

| LPG | 146 | 1 | -13.5 | 120 | 1 | -19.5 | 20 | 1 | -1.0 | |

| Refined Products | -- | -- | -- | 13 | 0.1 | -33.0 | 1,826 | 80 | 17.4 | |

| Uranium | 2,760 | 13 | 30.9 | 2,260 | 13 | -2.5 | -- | -- | -- | |

| Total Energy Commodities | 20,917 | 97 | 0.7 | |||||||

| Renewable Energy | 554 | 3 | 8.1 | -- | -- | -- | -- | -- | -- | |

| Total | 21,470 | 100 | 0.8 | 17,164 | 100 | -4.3 | 2,273 | 100 | 6.8 | |

Notes

Growth 2022–23 (%) relative to 2021–22. The share of production by fuel types differs from that published in the Australian Energy Statistics due to inclusion of uranium in this table.

Source: DCCEEW, Australian Energy Statistics, Table J and S2, August 2024

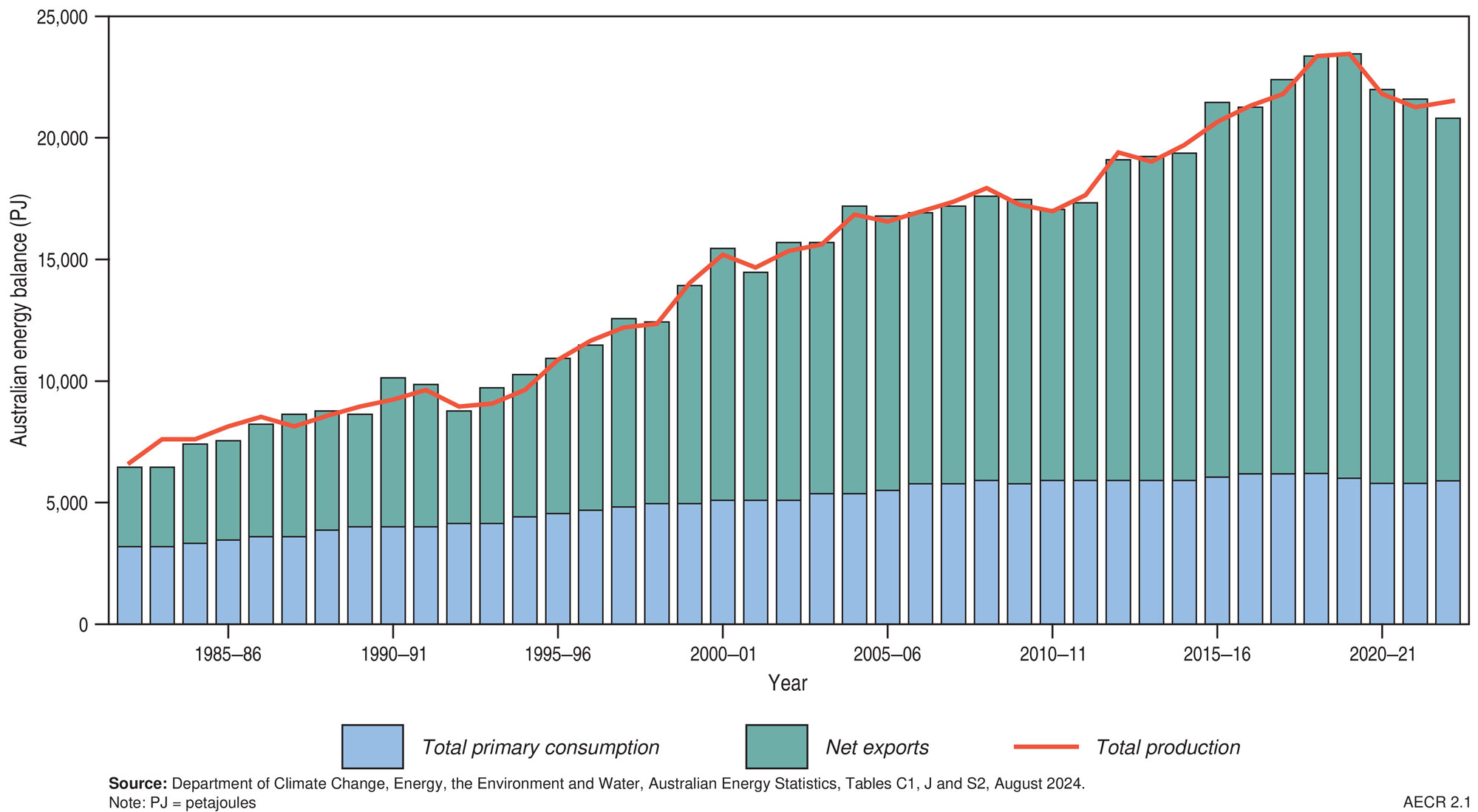

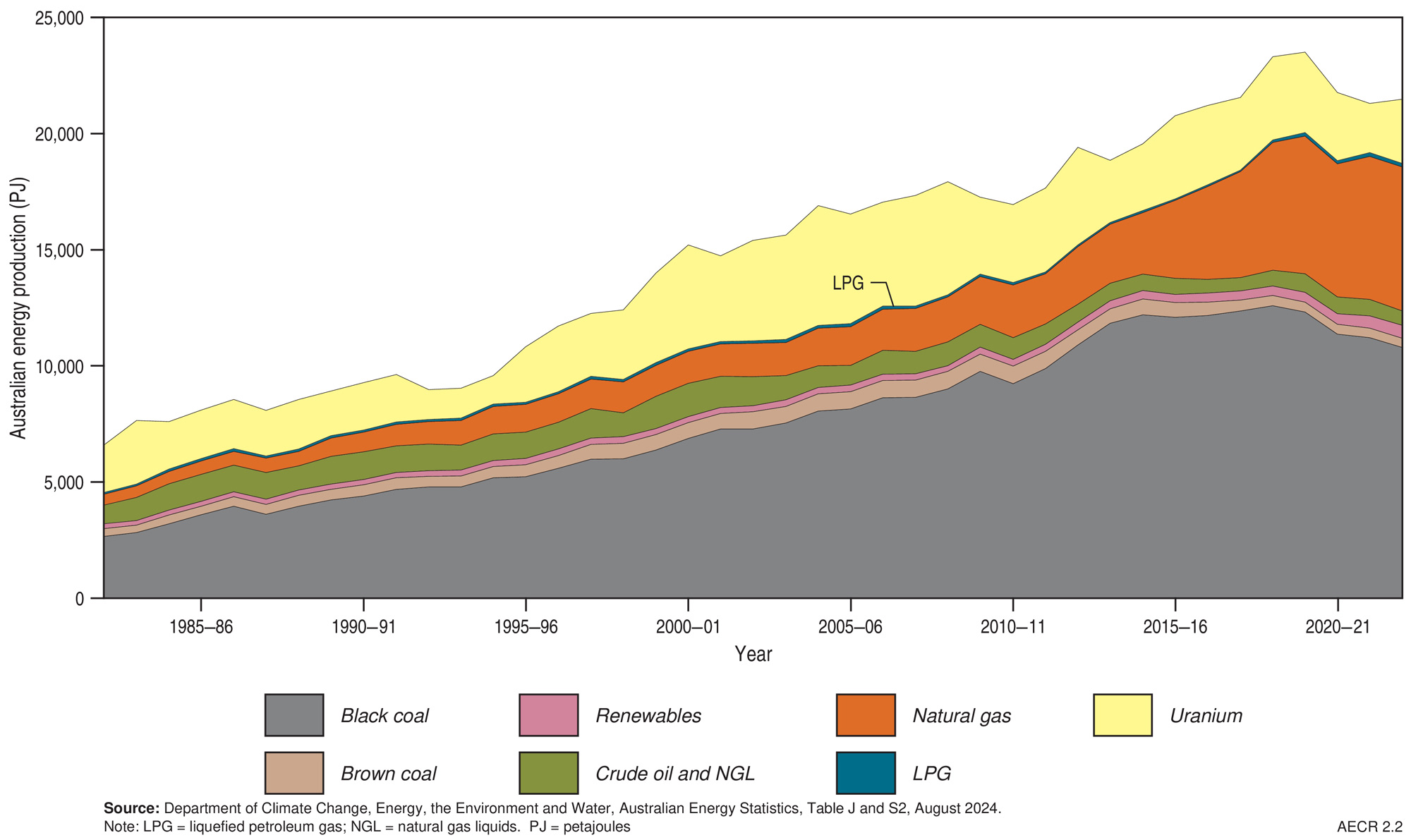

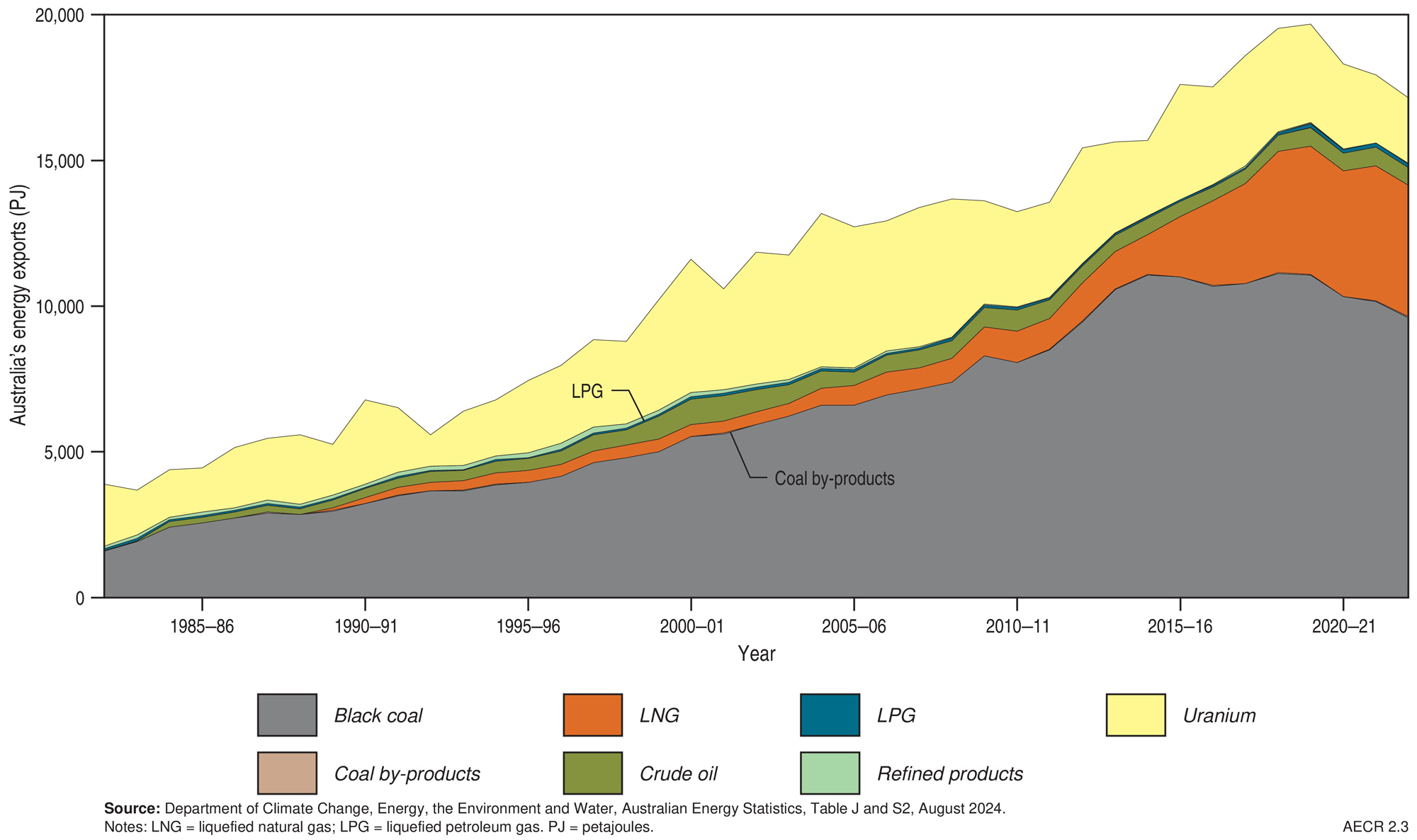

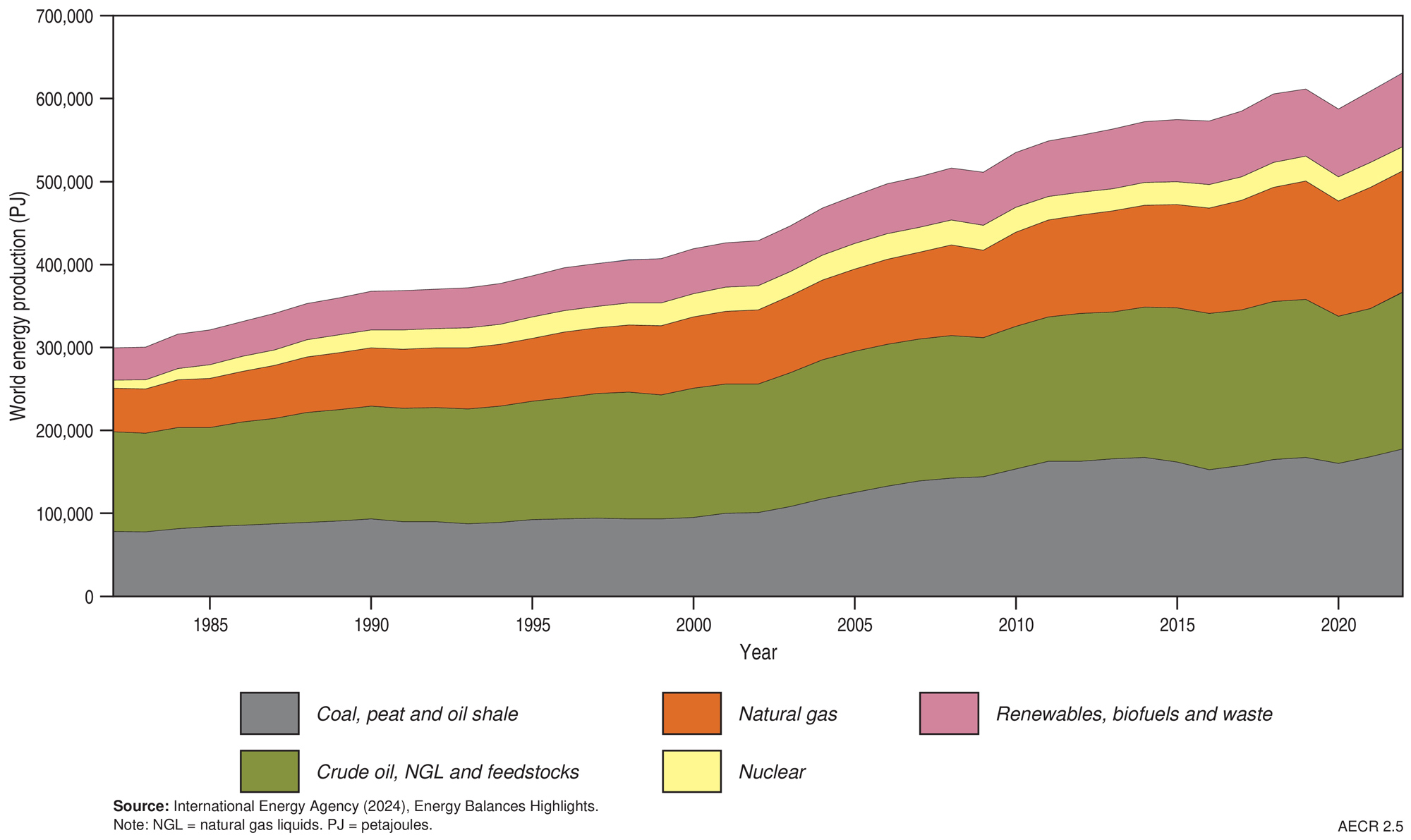

Australia’s total energy resources production increased by 0.8% to 21,470 PJ in 2022–23 (Table 2.1; Figure 2.1; Figure 2.2), largely due to a 30.9% increase in uranium production. Natural gas production grew by nearly 1% and renewable energy production continued to show significant growth, up 8.1%. Coal production declined by almost 4%, and oil and LPG production decreased by more than 13%. Australia continued to be a net exporter of energy commodities, with exports totalling more than seven times imports (Table 2.1; Figure 2.3).

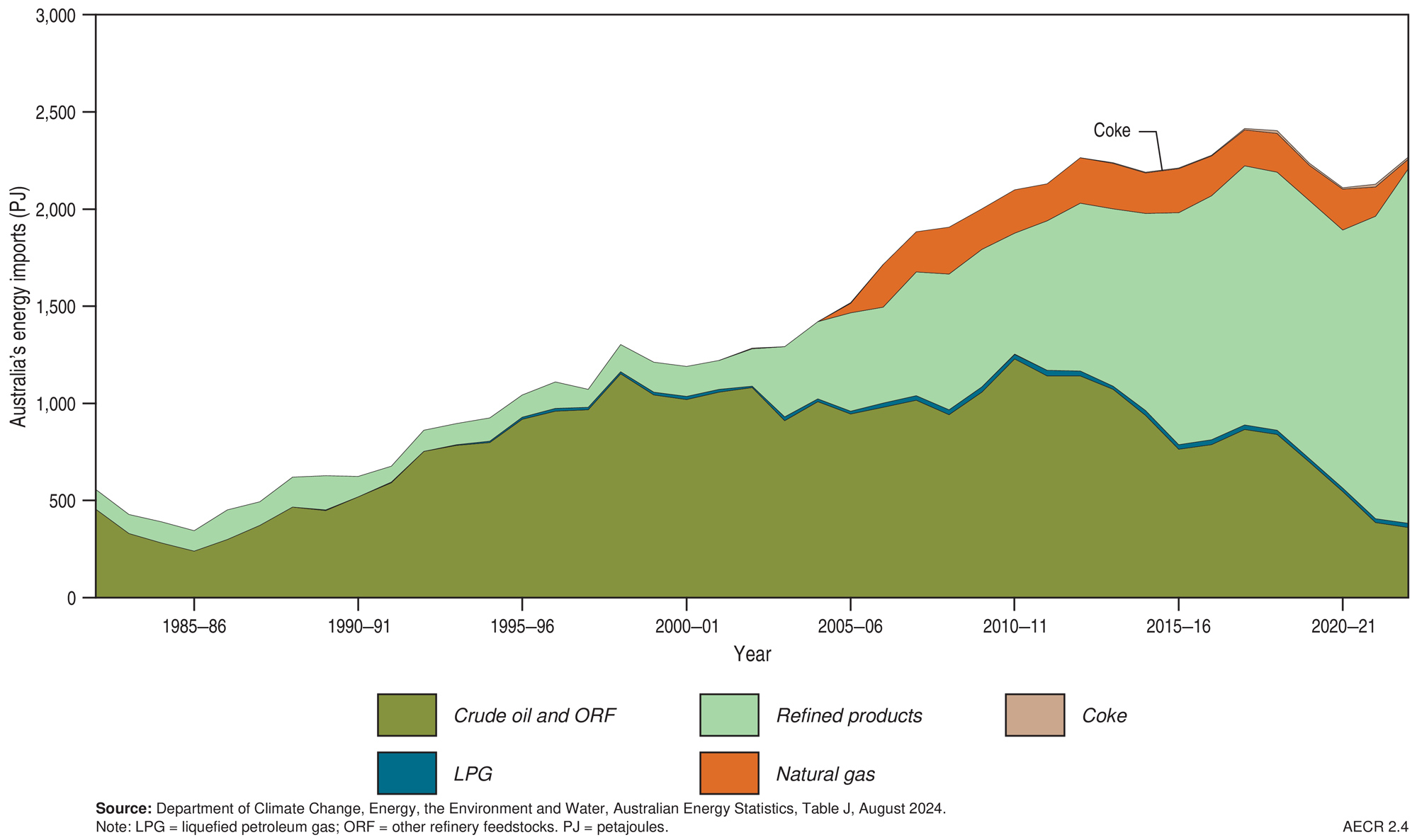

In 2022–23 Australia’s overall energy commodity exports fell by 4.3% to 17,164 PJ (Table 2.1), going against the annual growth rate of 1.1% over the past decade; the fall in 2022–23 was mostly due to reductions in black coal, LNG and uranium exports. Energy commodity imports grew significantly during 2022–23 to 2,273 PJ, up 6.8%, largely driven by a 17.4% increase in imports of refined products such as diesel and gasoline (Figure 2.4). Conversely, imports of crude oil and natural gas liquids (NGL) decreased by 10.8%.

Australia’s energy resources contribute substantially to the nation’s gross domestic product and export earnings. Energy productivity (gross domestic product ‘GDP’ divided by energy consumption) improved by 1.0% in 2022–23, and by 28% over the past ten years (DCCEEW, 2024). Australia now creates $409 million in GDP for every petajoule of energy consumed (DCCEEW, 2024). Australia is a net exporter of energy commodities but, notwithstanding this, remains a net importer of oil products. Approximately 80% of Australian produced energy (including uranium) was exported in 2022–23. Exports of LNG have been one of the main contributors to recent growth in our energy exports.

Black coal (metallurgical and thermal) and natural gas (LNG) account for most of Australia’s energy resource export value (Table 2.2). In 2022–23 Australia’s energy commodity export earnings continued to grow, reaching a record A$238.7 billion, up A$34.7 billion (17%) from the previous year. Export values of thermal coal (A$65.5 billion), LNG (A$92.2 billion) and uranium (A$0.8 billion) all grew significantly, up 41.6%, 30.7% and 43.8% respectively from 2021–22.

Table 2.2 Annual value of Australian energy commodity exports by fuel type, 2022–2023 financial year

| Energy source | Value (AUD$ billion) | Share (%) | Annual growth 2022–23 (%) | Compound annual growth 2012–13 to 2022–23 (%) |

|---|---|---|---|---|

| Crude oil and ORF | 13.2 | 5.5 | -6.0 | 2.4 |

| LPG | 1.6 | 0.7 | 6.1 | 3.9 |

| Bunker fuel | 3.1 | 1.3 | -0.6 | 6.7 |

| Other petroleum products | 0.4 | 0.2 | -15.8 | -5.4 |

| Natural gas (LNG) | 92.2 | 38.6 | 30.7 | 20.5 |

| Metallurgical coal | 61.9 | 25.9 | -8.4 | 10.7 |

| Thermal coal | 65.5 | 27.4 | 41.6 | 15.0 |

| Uranium | 0.8 | 0.3 | 43.8 | -0.1 |

| Total | 238.7 | 100.0 | 17.0 | 13.4 |

Notes

Source: Department of Industry, Science and Resources, Commonwealth of Australia Resources and Energy Quarterly September 2024, Table 2(2)

Australia in the world energy market

In 2023, global energy demand continued its long-term growth, with primary energy consumption increasing by 2%. Fossil fuel consumption accounted for the majority of this increase (60%), growing by more than 4%. Renewable energy consumption continued to grow rapidly, up 12% from 2022, accounting for 44% of growth in 2023 (Energy Institute, 2024). Nuclear energy consumption also increased by nearly 2% globally.

Primary energy production totalled 631,032 PJ in 2022, with China, the US and Russia accounting for 46% of all energy production. Australia was ranked the eighth highest primary energy producer in 2022, accounting for 2.9% (18,186 PJ) of world primary energy production (IEA, 2024). Most global primary energy production was from oil (30%), coal (28%), and natural gas resources (23%), with renewables (14%) and nuclear (5%) making up the remainder (Figure 2.5).

Highlights for 2023 calendar year:

- Australia was the 7th largest global gas producer and the world’s third largest LNG exporter.

- Australia was the world’s fifth largest producer of coal (black and brown), accounting for 6.5% of global production. It remained the second largest exporter of coal (black and brown), holding the leading position in metallurgical coal exports and the second position for thermal coal exports (DISR, 2024).

- Australia was the world’s fourth largest producer of uranium, accounting for 8.6% of global production.

Table 2.3 Summary statistics for Australia’s energy commodity reserves, production and exports and their world rankings, 2023 calendar year. Data has been compiled in calendar year to enable international comparison.

| Resource | Sub-category | Reserves (PJ) | Reserves world ranking (share) | Production (PJ) | Production world ranking (share) | Exports (PJ) | Export world ranking (share) | Export value (A$b) |

|---|---|---|---|---|---|---|---|---|

| Gas | All | 105,148 | na | 6,264 | 7 (3.7%) | 4,388 | 3 (20%) | 74.3 |

| Conventional | 74,586 | 4,800 | ||||||

| Coal Seam Gas | 30,859 | 1,562 | ||||||

| Oil | All | 7,552 | na | 619 | 31 (0.4%) | 703 | na | 14.5 |

| Crude | 1,347 | 182 | ||||||

| Condensate | 5,786 | 397 | ||||||

| LPG | 419 | 40 | ||||||

| Coal | All | 2,585,916 | 11,184 | 5 (6.5%) | 9,606 | 2 (25%) | 103.2 | |

| Black | 1,855,256 | 4 (9%) | 10,784 | 5 (6%) | ||||

| Brown | 730,660 | 2 (23%) | 401 | 9 (3%) | ||||

| Uranium | 185,360 | 1 (32%) | 2,624 | 4 (8.6%) | 2,535 | 0.9 |

Abbreviations

PJ = Petajoules.

Notes

Statistics are for the 2023 calendar year except coal production and exports (PJ) which are for financial year 2022-23.

Sources: Geoscience Australia; Hughes et al. (2025); Energy Institute (2024) Statistical Review of World Energy; DISR (2024) Resources and Energy Quarterly, September 2024; OECD, NEA and IAEA (2025) Uranium 2024: Resources, Production and Demand; DCCEEW (2024) Australian Energy Update 2024.

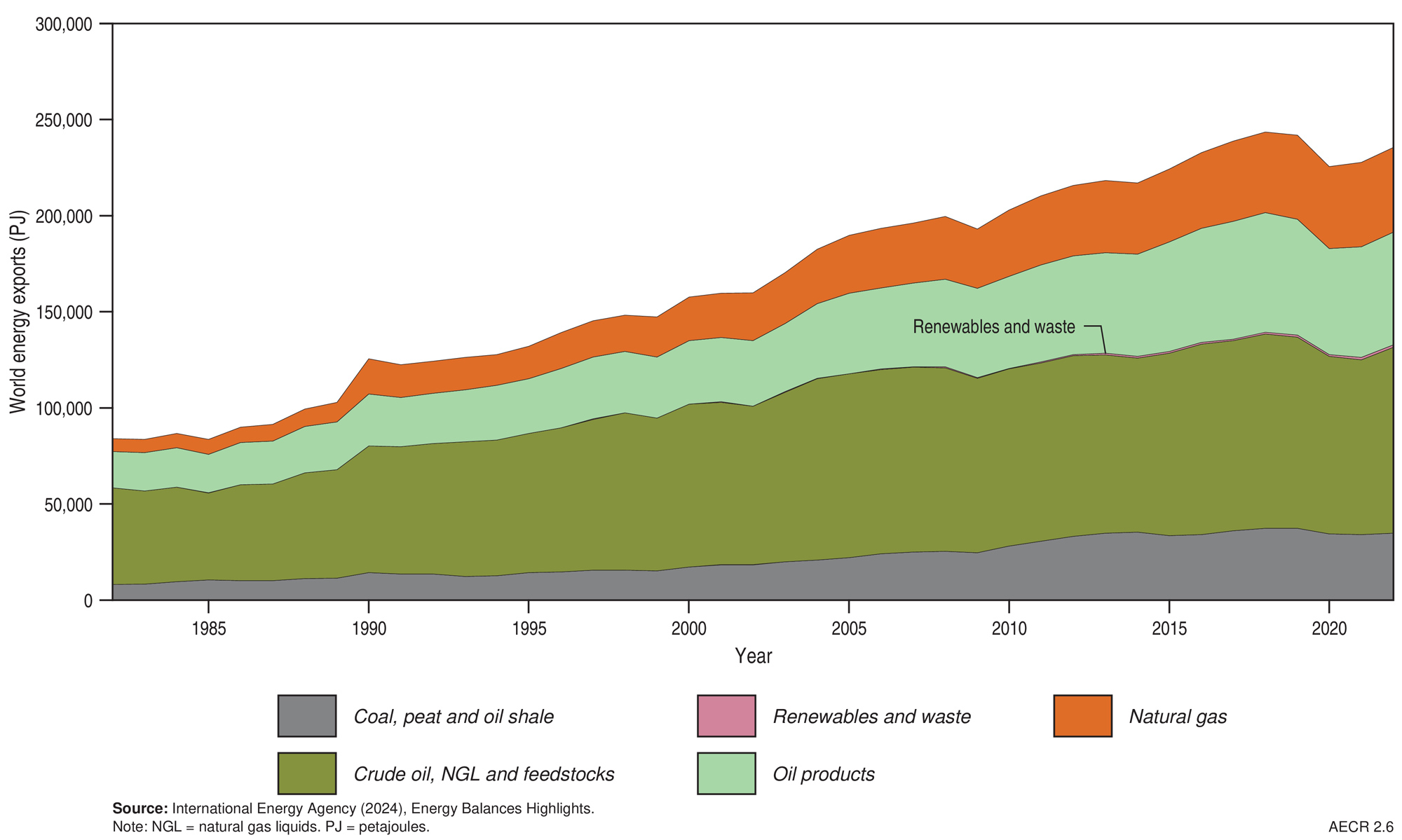

World trade

The IEA reports on the global trade of energy resources in its World Energy Balances publication, the most recent available data is for 2022 (one year behind the 2023 reporting period for this edition of AECR). In 2022 global exports of fossil fuels totalled 234,537 PJ (Figure 2.6) including 96,682 PJ of oil resources (41% share), 58,867 PJ of oil products (25% share), 44,121 PJ of natural gas (19% share), and 34,867 PJ of coal (15% share; IEA, 2024). Australia was the 4th largest exporter of energy commodities in 2022, being amongst the top exporters of both coal and LNG. Approximately 49% of fossil fuel exports during this period originated from six countries—the Russian Federation (12.4%), the United States (11.4%), Saudi Arabia (8.4%), Australia (6.2%), Canada (5.8%) and Indonesia (4.9%; Table 2.4).

Table 2.4 World energy exports by country in 2022

| Country | Energy exports (PJ) | World share (%) | Rank | Major energy exports |

|---|---|---|---|---|

| Russian Federation1 | 29,125 | 12.4 | 1 | Largest natural gas exporter (pipeline & LNG) and major exporter of oil and coal |

| United States | 26,827 | 11.4 | 2 | Major exporter of oil and natural gas |

| Saudi Arabia1 | 19,680 | 8.4 | 3 | Largest oil and NGL exporter |

| Australia | 14,613 | 6.2 | 4 | Second largest exporter of coal, major exporter of LNG |

| Canada | 13,673 | 5.8 | 5 | Major exporter of oil and natural gas |

| Indonesia | 11,533 | 4.9 | 6 | Largest coal exporter |

| World total | 234,537 |

Notes

Includes coal, natural gas, crude oil and natural gas liquids (NGL), and oil products.

Sources: IEA (2024) Countries and regions; 1Energy Institute (2024)

References

DCCEEW (Department of Climate Change, Energy, the Environment and Water), 2024a. Australian Energy Update 2024.

DISR (Department of Industry, Science and Resources), 2024. Resources and Energy Quarterly, September 2024.

Energy Institute, 2024. Statistical Review of World Energy.

Geoscience Australia, 2024. Australia’s Energy Commodity Resources, 2024 Edition. Geoscience Australia, Canberra.

Hughes, A., Britt, A., Pheeney, J., Morfiadakis, A., Kucka, C., Colclough, H., Munns, C., Senior, A., Cross, A., Hitchman, A., Cheng, Y., Walsh, J., and Jayasekara, A., 2025. Australia’s Identified Mineral Resources 2024. ;Geoscience Australia, Canberra.

IEA (International Energy Agency), 2024. World Energy Balances highlights, data download.

Organisation for Economic Co-operation and Development, Nuclear Energy Agency, and International Atomic Energy Agency (OECD, NEA and IAEA), 2025. Uranium 2024: Resources, Production and Demand (last accessed July 2025)

Data download

Data tables and full report are downloadable from the Geoscience Australia website.